⚡ Why This Blog Matters

Bad credit can hold you back—but AI-powered credit repair tools can streamline dispute workflows, monitor changes, and help boost scores faster.

🧠 What You’ll Learn Here

Learn how top tools like CreditFix AI and ScoreBoost Pro automate credit report analysis, generate dispute letters, track result timelines, and offer coaching tailored to credit mistakes—all with transparent pricing models.

🎯 Who Should Read This

Ideal for consumers, first-time borrowers, homebuyers, and financial advisors seeking smart, efficient methods to repair credit and improve financial health using AI assistance.

Managing credit can feel confusing, especially when credit reports contain outdated or inaccurate information. That’s where technology has stepped in. Today, AI-powered credit repair tools are making it easier for people to track, understand, and improve their credit profiles without relying entirely on traditional agencies or manual paperwork.

These tools scan reports, highlight potential issues, and even prepare dispute letters automatically. The big question is: Do they really work? And more importantly, are they worth your time or money?

This blog takes a closer look at how AI credit repair platforms function, what features matter most, and how they might support your journey to a better credit score.

What Are AI Credit Repair Tools and How Do They Work in 2025?

AI credit repair tools use automation to help people manage and improve their credit reports more efficiently. Here’s how they work and why they’re gaining attention:

- Automated Error Detection: These tools scan your credit report for outdated, duplicate, or incorrect information, saving you time and effort.

- Dispute Letter Generation: Many platforms can automatically create pre-filled dispute letters that you can review and send to credit bureaus.

- User-Friendly Access: You can access these tools through mobile apps or web platforms, making it easier to track your credit progress anytime.

- Machine Learning Insights: Some tools analyze your financial behavior and provide suggestions to improve your score, like paying down certain debts or reducing credit usage.

- Hands-On Control: Ideal for users who prefer to take charge of their credit without relying on expensive or slow-moving third-party services.

These tools are not just about convenience—they offer a structured way to monitor, correct, and improve your credit profile over time.

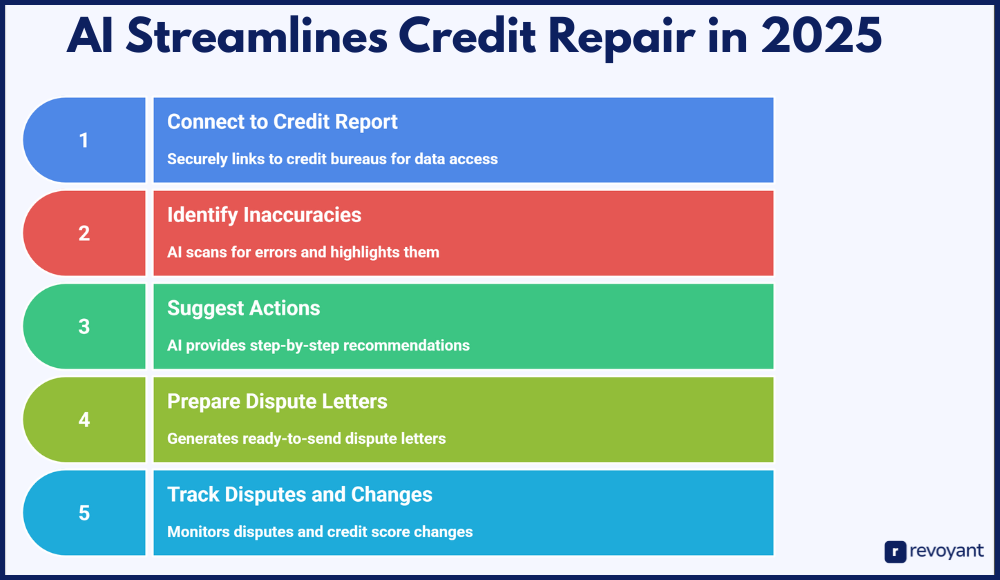

How AI-Powered Automation Simplifies Credit Repair in 2025

Credit repair used to be a time-consuming process filled with paperwork, phone calls, and uncertainty. Now, AI-powered tools have made it much simpler by automating each major step. These tools don’t just organize information—they analyze it, take action where needed, and guide users through the process in a clear, structured way.

Here’s how the automation works in practice:

Connects to Your Credit Report Automatically

After you sign up and verify your identity, the platform links to your credit report through secure integrations with major credit bureaus like Experian, Equifax, and TransUnion. This eliminates the need to download reports manually or copy data over.

The tool pulls a complete view of your credit history—payment records, open accounts, inquiries, collections, and more—so you have everything in one place. For most users, this is the first time they’re able to see their credit situation laid out in a way that’s easy to understand.

Identifies Inaccuracies and Problem Areas

Once your report is synced, the AI system gets to work. It runs a comprehensive scan of your file, looking for entries that could be dragging down your score. These can include:

- Accounts that don’t belong to you

- Duplicated entries

- Late payments that were actually made on time

- Outdated collections that should’ve aged off

- Incorrect balances or credit limits

The software highlights these issues visually—often with simple color codes or checklists—so you can quickly review what needs attention.

Suggests What to Do Next

Not everyone knows how to read a credit report or what action to take. That’s why AI tools provide step-by-step recommendations.

For example:

- If an account is reported as late but you have proof of payment, it will suggest opening a dispute.

- If your credit utilization is high, the system might recommend paying down a specific account first.

- If a hard inquiry wasn’t authorized, it will flag it for possible removal.

These suggestions help you focus on what really matters, instead of guessing where to begin.

Prepares Dispute Letters in a Few Clicks

One of the most helpful features of these tools is their ability to generate ready-to-send dispute letters. You don’t need to draft anything manually or figure out the right legal language.

Here’s how it typically works:

- You select the issue (e.g., “This collection was paid” or “This isn’t my account”)

- The tool fills in a dispute letter with the correct format and language

- You review and confirm the letter

- Some platforms even send it electronically on your behalf

This turns a stressful task into a few minutes of work—and ensures the disputes are handled correctly.

Tracks Disputes and Credit Score Changes Over Time

Once the disputes are submitted, the automation doesn’t stop. The platform keeps monitoring your report for updates from the credit bureaus.

You’ll usually receive:

- Notifications if the status of a disputed item changes

- Alerts if your credit score improves or drops

- A timeline of when actions were taken and what results came from them

This gives you full visibility into your progress and helps you stay proactive—without needing to follow up manually or set your own reminders.

Summary

At its core, automation in credit repair is about turning a confusing, slow-moving process into something simple, guided, and repeatable. It doesn’t replace personal responsibility, but it does give users a clear framework to take charge of their credit health—without the stress and guesswork.

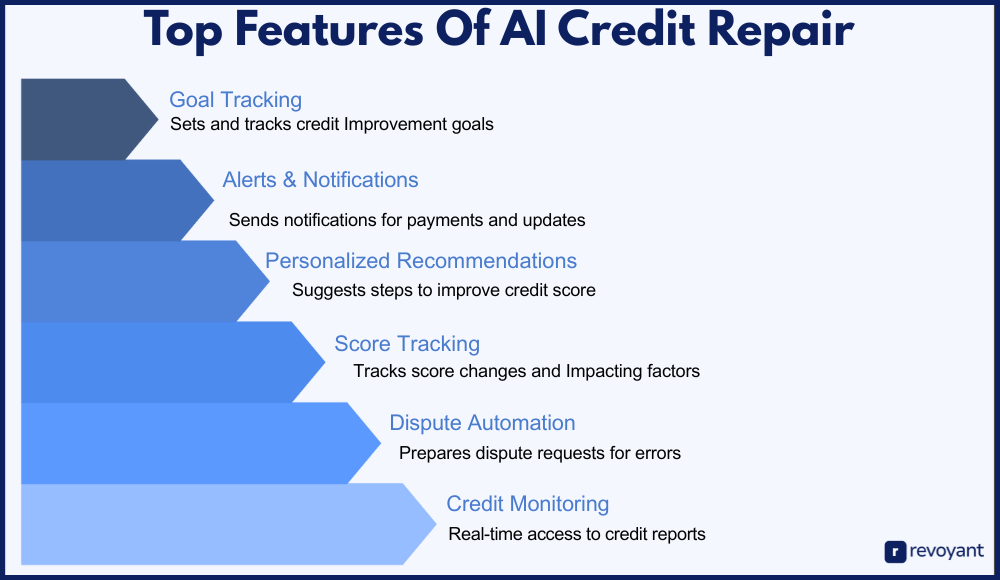

Top Features to Look for in AI Credit Repair Software

AI credit repair tools combine smart automation with credit education, helping users take control of their financial journey. Below are the most useful features you’ll typically find in these platforms, along with how they work in real-world situations:

Credit Report Monitoring

These tools connect directly with one or more major credit bureaus—Experian, Equifax, and TransUnion—to give you real-time access to your credit reports. Instead of pulling your report manually, the platform automatically keeps track of changes, such as new accounts, closed loans, updated balances, or payment history. This helps you spot any unfamiliar activity early, giving you a chance to act quickly if something looks off.

Dispute Automation

If the software detects a potential error on your credit report—like a duplicate account, incorrect balance, or payment you know you made—it prepares a dispute request for you. In most tools, you can review, edit, and send the dispute directly to the credit bureau with just a few clicks. This replaces the traditional method of writing and mailing physical letters, saving time while increasing the chances of a resolution.

Score Tracking

Instead of checking your credit score once in a while, these tools offer a built-in score tracker that shows how your score changes week to week or month to month. Some platforms also break down the factors that impact your score, like credit utilization, payment history, and account age. This gives you a better understanding of what’s helping or holding back your credit score.

Personalized Recommendations

Using data from your credit profile, the tool may suggest next steps to help improve your score. For example, it might recommend paying down a credit card that’s close to its limit or setting up autopay to avoid future late payments. These insights are based on your actual behavior—not generic advice—which makes them easier to act on.

Alerts and Notifications

Life gets busy, and it’s easy to forget due dates or miss important updates. AI credit tools send notifications for upcoming payments, changes in your credit report, or sudden drops in your score. These alerts give you more control and help prevent issues that could hurt your score unnecessarily.

Goal Tracking

Improving credit often takes time, and progress isn’t always visible right away. Many tools let you set specific goals—such as reaching a 700+ score, qualifying for a mortgage, or clearing a certain amount of debt—and track your journey step by step. This feature helps you stay motivated and focused, turning long-term goals into smaller, achievable wins.

These features are designed to simplify the credit repair process for everyday users—whether you’re just getting started or looking to rebuild after a setback. The convenience, speed, and guidance they offer can make a noticeable difference in how you manage your credit.

Who Should Use AI Credit Repair Tools—and Why They Work

AI credit repair tools are designed to support a wide range of users. Whether you’re trying to fix past mistakes, prepare for a financial milestone, or simply stay informed, these tools make it easier to manage credit without getting lost in the fine print. Here’s who finds them especially helpful:

📉 Low or Average Credit Scores

Fix errors and improve scores with automated guidance.

💼 Freelancers & Self-Employed

Manage credit usage and stay loan-ready with smart alerts.

🏡 Planning Major Purchases

Polish your credit before applying for big-ticket loans.

📱 Digital-First DIY Users

Take control with easy tools and on-demand insights.

🎓 Young Adults Starting Out

Learn credit habits and build your score from day one.

Individuals with Low or Average Credit Scores

Many users come to these tools after a few financial missteps—maybe a missed payment, a defaulted loan, or high credit card usage. Instead of guessing what’s hurting their score, they want real answers and a way to move forward. AI tools scan their credit reports, error detection, and create action plans to help correct or reduce the impact of those issues. For someone who’s serious about turning things around, this kind of targeted support saves time and removes the guesswork.

Freelancers, Gig Workers, and Self-Employed Professionals

Not having a regular paycheck can sometimes lead to inconsistent payment patterns or high credit utilization during lean months. Traditional lenders may view this as risky—even when income levels are strong. AI tools help independent earners stay on top of their credit usage, manage payment reminders, and plan for fluctuations. These platforms also make it easier to track how credit actions affect their score over time, helping them stay loan-ready without needing outside help.

People Preparing for Large Financial Moves

Planning to buy a home or apply for a business loan? Your credit score plays a big role in what terms you’ll get. Users in this group rely on AI credit repair software to tighten their credit profile before applying—removing errors, lowering debt ratios, or ensuring payment history is spotless. Since many tools offer timelines and projections, they can actually map out how soon they might qualify for better rates or approval thresholds. If part of your plan is to borrow against your home, it’s also worth understanding how HELOCs compare with home equity loans so you can choose between a revolving line and a fixed lump sum.

Digital-Savvy Consumers Who Want More Control

Some users don’t want to rely on third-party repair agencies. They prefer doing it themselves—with guidance. AI-powered platforms give these users the autonomy they want, without having to manually analyze credit reports or draft complex letters. With a simple interface, automated support, and clear insights, they get the benefits of a structured repair process, all from a smartphone or laptop.

Young Adults New to Credit

Building credit from scratch is different than repairing it—but just as important. Students and early-career professionals often don’t know what steps impact their score the most. AI credit tools act like a virtual coach—showing them how things like opening a secured card, paying on time, or keeping credit limits low can influence their score. It’s an educational experience wrapped in automation, helping them build positive credit habits early on.

In short, AI credit repair tools are for anyone who wants better clarity, control, and consistency in how they manage their credit—whether they’re starting fresh or fixing what’s already there.

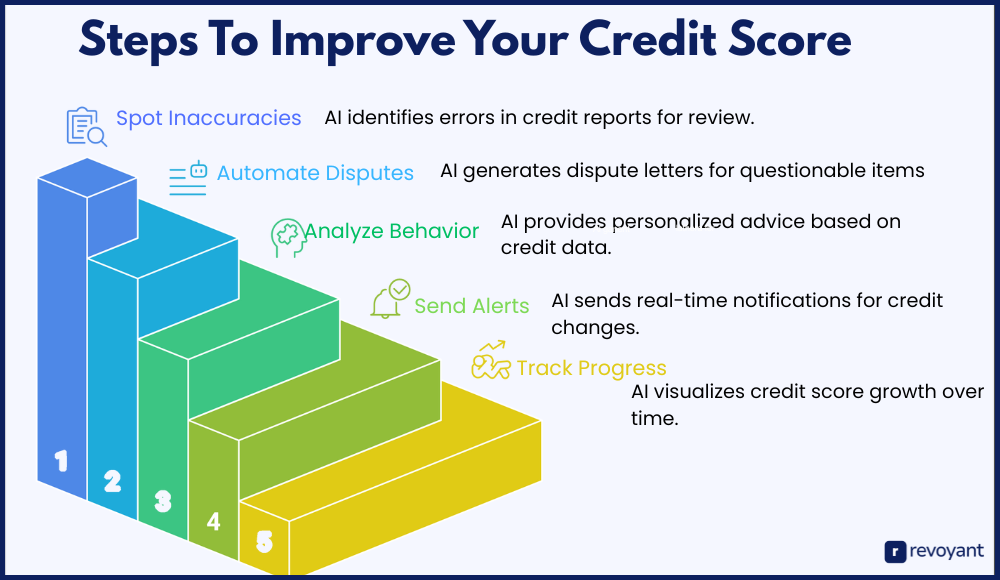

How AI Can Improve Your Credit Score: Real-Life Examples

AI credit repair tools aren’t just about convenience—they’re built to help you take real steps that support your credit profile. By analyzing your data and identifying patterns, they suggest timely actions that can move your score in the right direction. Here’s how they help in practical terms:

Spotting and Flagging Inaccuracies

One of the most effective ways AI tools contribute to credit improvement is by scanning your reports for possible errors. Whether it’s an account you never opened, a late payment that was actually on time, or outdated information that should’ve been removed, the system flags these items for review. Since errors can drag your score down, identifying them early can make a measurable difference.

Disputing Items with Automation

Once a questionable item is found, most platforms generate a pre-filled dispute letter you can send directly to the credit bureau. These letters are crafted to match the reporting format bureaus recognize, making it easier to communicate your case. You get to review the content before it goes out, giving you full control while saving hours of manual work.

Analyzing Credit Behavior and Offering Guidance

Beyond disputes, AI credit tools offer personalized advice on how to improve your score over time. For example, they may recommend reducing your credit utilization, setting up payment reminders, or avoiding hard inquiries for a few months. These suggestions are based on your actual credit data—not just general tips—so they’re easier to act on.

Sending Real-Time Alerts to Stay on Track

If your balance suddenly spikes or a new account is added to your report, the tool sends you an alert. These notifications keep you informed so you can respond quickly—whether that means paying down a balance before the due date or checking for potential fraud. Staying updated helps avoid surprises and supports healthier credit habits.

Tracking Progress and Showing Impact

Most platforms provide a score tracker that lets you visualize your credit growth. If you followed a suggestion to pay off a credit card, you might see your score rise in the following weeks. This real-time feedback reinforces good habits and builds confidence, especially when preparing for larger financial decisions.

By combining data insights, automation, and clear guidance, AI tools offer a smarter way to manage and improve your credit without the complexity of traditional methods.

AI Credit Repair Tool Pricing in 2025: Free vs Paid Plans Compared

Understanding the cost of AI credit repair tools is just as important as knowing what they offer. Pricing varies based on the level of automation, features, and support each tool provides. While some platforms offer free access to basic features, others unlock their full potential through monthly or annual subscriptions.

| Plan Type | Price Range | What’s Included |

|---|---|---|

| Free Plans | $0/month | Credit monitoring, basic alerts, positive payment reporting (e.g., Credit Karma, Experian Boost) |

| Basic Plans | $19–$29/month | Credit report integration, basic dispute support, customer assistance |

| Mid-Tier Plans | $39–$59/month | Unlimited disputes, score tracking, custom letters, goal tools |

| Premium Plans | $60+/month | Multi-user access, priority support, advanced analytics or business tools |

| Annual Plans | Discounted (varies) | Lower cost for long-term use; ideal for users committed to a 6–12 month plan |

Here’s how pricing typically breaks down in 2025:

Free Plans with Limited Access

Platforms like Credit Karma and Experian Boost offer useful features at no cost. You can monitor your credit, receive basic alerts, and even add positive payment history—without paying a subscription fee. These tools are perfect for beginners or users who want to test things out before committing to a paid plan.

Subscription-Based Models for Full Automation

More advanced platforms like Credit Versio or DisputeBee operate on monthly plans. These can range from $19 to $99 per month, depending on the service tier.

Here’s what’s usually included at different pricing levels:

- Basic Plans (around $19–$29/month): Access to credit report integration, basic dispute generation, and customer support.

- Mid-Tier Plans (around $39–$59/month): Add features like unlimited disputes, credit score tracking, and advanced letter customization.

- Premium Plans (above $60/month): Ideal for power users or professionals, often including priority support, multi-user accounts, or business-grade features.

One-Time or Annual Payment Options

Some platforms give users the choice to pay annually for a discount. If you’re planning to use the software over a longer period, this can reduce your overall cost. One-time setup fees are rare but may apply for white-label or business versions of certain tools.

Free Trials and Refund Policies

Many AI credit repair platforms offer free trials for 7 to 14 days, allowing you to explore core features before being charged. This trial period is a great opportunity to see if the tool fits your workflow. Be sure to check cancellation terms—some providers auto-renew unless canceled manually.

When comparing pricing, it helps to think about how much value you’re likely to get. If fixing errors helps you qualify for a lower interest rate or refinance a loan, even a $49/month plan could save hundreds in the long run.

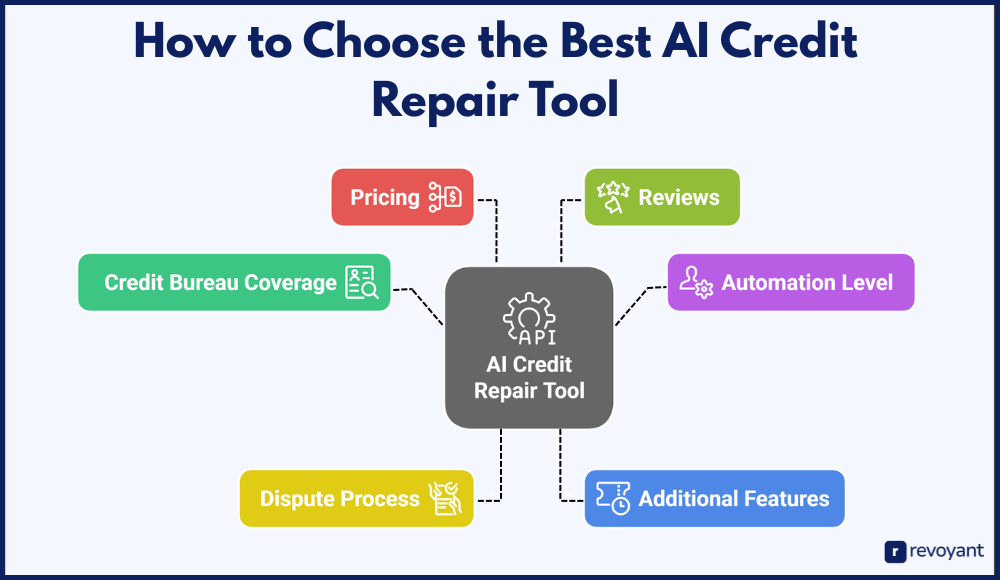

How to Choose the Best AI Credit Repair Tool for Your Credit Goals

With so many options on the market, choosing the right AI credit repair tool can feel like a challenge. But if you focus on what matters—like your current credit status, goals, and comfort level—you can find a platform that works for you without overpaying or overcomplicating things. Below are key factors to help guide your decision:

Look for Credit Bureau Coverage

Start by checking which credit bureaus the platform connects with. Ideally, the tool should pull reports from Experian, Equifax, and TransUnion, giving you a complete view of your credit profile. Some tools only integrate with one or two bureaus, which means you could miss out on spotting discrepancies across all reports. Since lenders check different bureaus depending on the product, full coverage gives you the best shot at cleaning up your credit across the board.

Check the Level of Automation

Ask yourself: Do you want a system that handles everything behind the scenes, or would you prefer to stay involved?

Platforms like Credit Versio offer guided automation—where you follow a step-by-step process, and the tool suggests and sends disputes for you. On the other hand, tools like DisputeBee are better for users who want to customize every detail. If you’re short on time or new to credit, an automated approach will likely feel smoother. But if you have specific items you want to explain or document, a tool that gives you full control might be a better fit.

Evaluate the Dispute Process

Not all tools handle disputes the same way. Some generate templated letters with limited options, while others allow you to edit and fine-tune each message. Look for tools that:

- Clearly explain what each disputed item means

- Help you select the right reason for challenging it

- Offer a review step before submission

- Track the status of each dispute and alert you when a bureau responds

This is especially useful if you plan to dispute multiple items over time or want visibility into how each case progresses.

Review Additional Features That Support Long-Term Growth

Credit repair is just one part of managing your credit. Many modern tools offer additional features like:

- Score simulators to test how different actions (like paying off debt or opening new accounts) could affect your score

- Financial goal tracking, so you can stay focused on a specific score target

- Bill reminders and utilization alerts, which can prevent issues before they occur

- Education hubs or credit insights, for users who want to learn while they repair

If your goal is to maintain healthy credit for the long term—not just fix one issue—these added tools provide ongoing value.

Compare Pricing with the Value You’ll Receive

Price is an important factor, but it shouldn’t be the only one. Some platforms start as low as $15–$20/month, while premium options with more automation or reporting tools might go up to $99/month.

Ask yourself:

- How many disputes will I be filing?

- Do I need reports from all three bureaus?

- Do I want to track my credit score weekly or monthly?

- Will I actually use features like goal-setting or score simulation?

By focusing on what you’ll realistically use, you can avoid paying for extras you don’t need—or missing out on tools that could help you reach your goals faster.

Read Real Reviews and Testimonials

No feature list or marketing copy can replace honest feedback from people who’ve used the platform. Look at review sites, discussion forums, or app store ratings. Pay attention to comments on:

- Ease of use and onboarding

- Response time from customer support

- Dispute success stories or common pain points

- Hidden fees or billing practices

- How often users saw real credit improvements

User feedback will give you a sense of how well the platform performs in day-to-day use—and what to expect after sign-up.

In the end, choosing the right AI credit repair tool isn’t just about features or pricing—it’s about fit. Find the one that matches how you work, supports your credit goals, and gives you the confidence to stay on track.

Alternatives to AI Credit Repair Tools: What to Use Instead

AI credit repair platforms offer convenience, but they’re not the only way to improve your credit. Depending on your situation, preferences, and budget, there are a few other effective methods you can consider. Each alternative comes with its own pros and learning curve, so it’s worth understanding your options before making a decision.

| Alternative Method | How It Works | Best For |

|---|---|---|

| Manual Credit Repair (DIY) | Request reports, review for errors, and send dispute letters directly to bureaus. Templates and guides are available online. | Hands-on users comfortable managing their own reports |

| Credit Counseling Services | Nonprofit agencies help you budget, manage debt, and sometimes offer debt management plans. | Those overwhelmed by debt or needing expert financial guidance |

| Secured Credit Cards / Builder Loans | Use small deposits or installment payments to build credit history over time with positive activity. | People new to credit or rebuilding with limited history |

| Credit Repair Companies | Professionals manage disputes and communication with bureaus for a monthly fee. | Users who prefer expert handling and don’t mind the extra cost |

| Financial Literacy & Education | Online courses, blogs, or workshops that teach credit basics, budgeting, and responsible habits. | Anyone looking to build lasting credit habits and independence |

DIY Credit Repair: How to Fix Your Score Without AI Tools

If you’re comfortable reading your credit reports and want full control over the process, you can repair your credit on your own. This involves:

- Requesting reports from Experian, Equifax, and TransUnion (free once a year)

- Reviewing them line by line for errors or outdated items

- Writing and sending dispute letters directly to the bureaus

While it takes more time and effort, the DIY route gives you a clear understanding of what’s on your report—and there are free templates and guides available online to help.

How Credit Counseling Services Help You Repair Credit

Credit counseling agencies offer personalized support for people who need help with budgeting, debt management, or understanding credit. These are typically nonprofit organizations that:

- Review your financial situation

- Help create a realistic budget

- Offer strategies for improving credit without taking on more debt

Some even offer debt management plans (DMPs), which help consolidate payments and lower interest rates. If your credit issues stem from high unsecured debt, this can be a helpful option.

Use Secured Credit Cards or Builder Loans to Rebuild Credit

If your credit file is thin or your score is low due to limited activity, a secured credit card or credit builder loan can help you establish positive payment history.

- Secured credit cards require a refundable deposit and report activity to the bureaus

- Credit builder loans hold the loan amount in a secured account while you make monthly payments, and then release the funds once the loan is repaid

These tools don’t involve disputes—they’re meant to build or rebuild credit through consistent, on-time payments.

Should You Hire a Credit Repair Company? Pros & Cons

If you prefer a hands-off approach and are willing to pay for professional service, traditional credit repair companies may be an option. They assign a representative to handle your disputes, follow-ups, and ongoing communication with the bureaus.

Just keep in mind:

- These services can be costly (ranging from $79 to $150+ per month)

- Results are not guaranteed

- It’s important to research the company’s track record and customer reviews

Credit Education & Self-Learning: Smarter Ways to Boost Your Score

Improving credit doesn’t always require tools or services. Some individuals benefit most from learning how credit works. Online courses, community workshops, or finance blogs can provide the knowledge you need to take confident action. When paired with apps for budgeting and tracking payments, self-education can be a strong long-term strategy.

Whether you go with an AI tool or take one of these alternative paths, the key is staying consistent. Each method has its strengths—and the best choice often comes down to what fits your current financial situation, comfort level, and timeline for improvement.

Final Thoughts: Is AI Credit Repair the Right Move for You?

Improving your credit doesn’t have to feel overwhelming or slow. With the rise of AI credit repair tools, individuals now have access to powerful platforms that simplify the process, identify problems quickly, and offer personalized suggestions—right from a browser or phone.

These tools aren’t magic fixes, but they do remove many of the barriers that once made credit repair feel out of reach. Whether you’re correcting an old error, preparing for a loan, or building healthier credit habits, AI-powered solutions give you more control and clarity over your financial profile.

Of course, these platforms work best when used consistently and paired with responsible financial behavior. Paying bills on time, keeping balances low, and reviewing your credit reports regularly are still foundational to long-term success.

If you’re someone who prefers structure, speed, and smart support, exploring an AI credit repair tool could be a practical step forward. And if it helps you secure a better interest rate, qualify for a home, or simply gain peace of mind, the return on that decision might go far beyond your credit score.

FAQs About AI Credit Repair Tools in 2025

Do AI credit repair tools work with all credit bureaus?

Some tools work with all three major bureaus—Experian, Equifax, and TransUnion—while others may connect with only one or two. It’s a good idea to check which bureaus are supported before signing up so you’re not missing out on key data.

Can I use an AI credit repair tool if my credit is already fair or good?

Yes. These tools aren’t just for fixing problems—they’re also helpful for monitoring your score, tracking changes, and getting suggestions to maintain or improve your credit profile. Even users with decent scores use them to prepare for major purchases.

How long does it take to see results?

Most users see initial changes within 30 to 60 days, especially if errors are successfully disputed. For bigger improvements—like qualifying for loans or lowering interest rates—it can take 3 to 6 months or longer, depending on your credit history.

Are AI credit repair tools safe to use?

Reputable platforms use secure encryption and comply with financial data regulations to protect your information. Always review the privacy policy and look for well-reviewed tools with transparent practices.

What if I want to cancel my subscription later?

Most tools offer monthly plans with the option to cancel anytime. Be sure to check for auto-renewal terms and whether there’s a cancellation deadline to avoid being charged for the next billing cycle.