⚡ Why This Blog Matters

Finding profitable real estate deals can be guesswork—but HouseCanary uses AI property analytics and market forecasting to help investors strike smart, data-backed deals.

🧠 What You’ll Learn Here

See how HouseCanary evaluates property value, rental yield, appreciation potential, and local market trends with interactive dashboards, scenario modeling (buy/fix/flip), and exportable reports.

🎯 Who Should Read This

Ideal for real estate investors, property managers, realtors, and financial analysts looking to make smarter buying and selling decisions backed by AI insights.

In today’s fast-moving real estate market, timing and data make all the difference. Whether you’re evaluating a single-family rental or managing a large property portfolio, accurate insights are critical. That’s where HouseCanary comes in, a platform built to deliver AI-powered real estate analytics and property valuation tools that help professionals make smarter, faster decisions.

HouseCanary equips users with deep, predictive data so they can move with confidence. From investment forecasting to risk analysis, it’s designed for anyone who wants to level up how they assess property value in real time. In this guide, we’ll break down what HouseCanary does, how it works, who it’s best for, and why it’s earning attention across the real estate and lending industries.

Quick Highlights: Why HouseCanary Stands Out in 2025

- HouseCanary is an AI-powered platform that delivers accurate real estate analytics, property valuations, and market forecasts across the U.S.

- It’s built for real estate professionals including investors, lenders, brokers, and appraisers who rely on data to make smarter property decisions.

- The platform uses machine learning and massive datasets to generate predictive insights, offering more precision than traditional valuation methods.

- Key tools include automated valuations, rental analysis, risk scoring, and forecasting that help users evaluate opportunities and mitigate risk.

- HouseCanary supports both single-property evaluations and portfolio-level management, making it scalable for individuals and enterprises alike.

- With its focus on speed, accuracy, and future-focused insights, HouseCanary is a strong solution for professionals looking to stay competitive in 2025 and beyond.

What Is HouseCanary? AI for Smarter Real Estate Decisions

HouseCanary is a real estate analytics and valuation platform that uses artificial intelligence to deliver data-driven insights on residential properties across the United States. It’s designed to help professionals such as investors, lenders, appraisers, and brokers make confident, informed decisions based on real-time market intelligence.

The platform combines property-level data, historical trends, and proprietary forecasting models to generate highly accurate valuations, risk assessments, and market forecasts. Users can access tools that evaluate single properties or scale across entire portfolios, all from one streamlined interface.

At its core, HouseCanary is about speed, precision, and clarity. Whether someone is analyzing potential investments, underwriting loans, or determining property risk, HouseCanary gives them the insights they need without the guesswork.

How HouseCanary Uses AI to Predict Property Value & Risk

HouseCanary’s core strength lies in how it blends artificial intelligence with vast real estate data to deliver accurate, forward-looking property insights. Instead of simply reporting past sales or static comps, it builds predictive models that look ahead—helping users understand not just what a property is worth today, but what it could be worth in the future.

At the heart of HouseCanary’s engine are advanced machine learning algorithms trained on millions of property records, economic indicators, market trends, and geospatial data. This allows the system to identify patterns and price movements that aren’t always obvious at a surface level.

AI powers HouseCanary’s automated valuation models (AVMs), which are known for being both fast and highly accurate. These models are continuously refined using real-time data and feedback loops, which means valuations stay relevant even as markets shift.

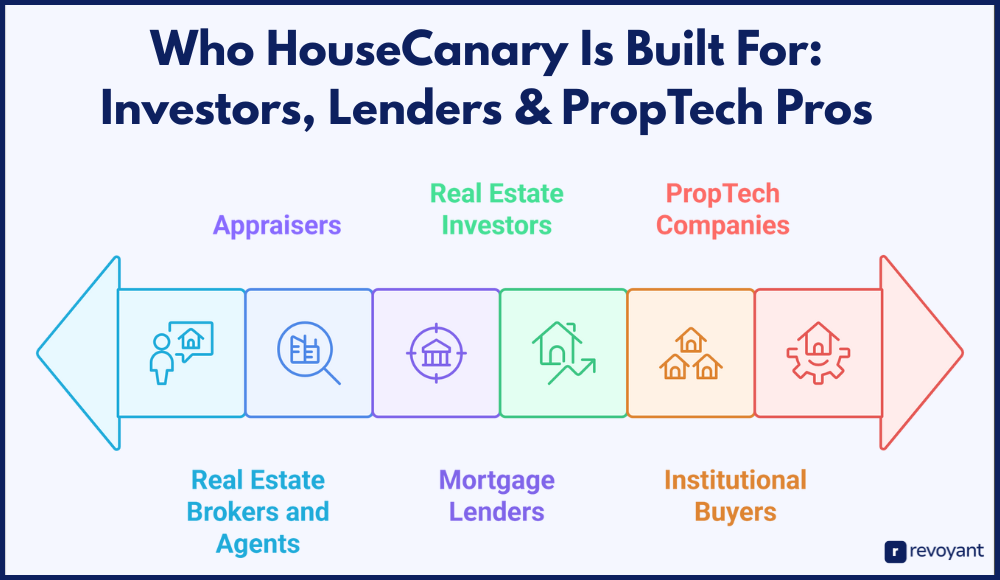

Who HouseCanary Is Built For: Investors, Lenders & PropTech Pros

HouseCanary serves a wide range of professionals across the real estate industry. Its AI-powered analytics and valuation tools are especially valuable for users who need fast, accurate insights to support high-stakes decisions. Here’s how different roles benefit from the platform.

How Investors Use HouseCanary to Analyze and Scale Deals

Real estate investors use HouseCanary to analyze deals with greater confidence. Whether evaluating a single-family home or an entire portfolio, the platform offers instant access to valuations, rent estimates, and future market forecasts. This allows investors to screen more opportunities in less time and avoid costly mistakes.

With detailed property-level insights, investors can spot undervalued assets, optimize rental income, and plan long-term strategies. HouseCanary also helps assess risk based on market volatility and neighborhood-level data. It’s a time-saver for seasoned investors and a game-changer for those scaling up.

Faster Underwriting for Lenders with AI-Powered Valuations

Lenders depend on accurate valuations and risk data to make fast, reliable lending decisions. HouseCanary helps streamline the underwriting process by providing real-time property values, market trends, and risk scoring. Instead of relying solely on traditional appraisals, lenders can verify collateral strength instantly and consistently.

This is especially useful for evaluating multiple loans or working with high-volume transactions. By reducing time to approval and improving accuracy, HouseCanary helps lenders operate more efficiently in a competitive market. It’s a key tool for balancing speed with confidence in loan origination.

How Brokers & Agents Use HouseCanary to Price & Sell Confidently

Agents and brokers use HouseCanary to bring credibility and clarity to every transaction. With access to real-time comps, market trends, and forecast data, they can guide clients with hard numbers instead of gut feeling. This is especially useful when pricing listings, negotiating offers, or preparing market analyses.

HouseCanary’s tools help agents build trust and close deals faster by backing up their advice with data. It also streamlines client presentations by offering easy-to-understand visuals and reports. For agents who want to stand out in competitive markets, it adds a smart edge to their service.

HouseCanary as a Smart Assistant for Real Estate Appraisers

For appraisers, HouseCanary offers a valuable complement to on-site inspections. Its AVMs, historical trends, and comp data help validate findings and reduce manual research time. This can be particularly helpful in areas with limited comparable sales or rapidly shifting prices.

While appraisers still rely on physical evaluations, HouseCanary gives them a data-rich foundation to support accurate reporting. The ability to cross-reference their analysis with predictive models adds depth and reliability. It’s not a replacement for appraising, but it’s a powerful assistant for faster, smarter evaluations.

Bulk Property Analysis for Institutional Buyers with HouseCanary

Institutional buyers such as REITs, hedge funds, and iBuyers rely on HouseCanary to evaluate large volumes of properties at scale. The platform enables bulk valuations, rent forecasts, and portfolio-level risk analysis—all essential for making quick, informed investment decisions. These buyers can assess hundreds or even thousands of properties without compromising accuracy.

With API access and enterprise-level tools, HouseCanary fits seamlessly into their workflows. It helps reduce friction in due diligence and accelerates acquisition timelines. For institutional players, speed and precision are everything—and HouseCanary delivers both.

How PropTech Companies Use HouseCanary’s API and Data Tools

PropTech companies use HouseCanary’s data infrastructure to power their own real estate platforms. With robust APIs and scalable data tools, developers can integrate AVMs, rent estimates, and forecasting features directly into their apps or systems. This allows them to build smarter products for investors, consumers, or lenders.

Whether it’s powering a home search platform, underwriting automation, or a valuation dashboard, HouseCanary supplies the backend intelligence that makes these tools smarter. It saves dev time while adding real estate credibility to any tech product. For PropTech innovators, it’s a plug-and-play solution with real impact.

HouseCanary Pricing: Plans for Individuals, Teams & Enterprises

HouseCanary offers flexible pricing plans designed for real estate professionals at every level—from solo investors to enterprise teams. Each plan includes access to powerful AI-driven valuation tools, market forecasts, and property analytics, with the number of users and reports scaling to fit your needs.

Whether you’re just starting out or managing a large portfolio, there’s a HouseCanary plan built to match your workflow and budget.

| Plan | Price | Ideal For | Key Features |

|---|---|---|---|

| Basic | $19/month or $190/year | Individuals with basic data needs |

– 1 user – 2 valuation reports/month – Limited CanaryAI access – Core platform access |

| Pro | $79/month or $790/year | Solo professionals and power users |

– 1 user – 15 valuation + AVM reports/month – Full CanaryAI – API access |

| Teams | $199/month or $1,990/year | Small to mid-sized real estate teams |

– 10 users – 40 reports/month – 50 property monitoring – CanaryAI + advanced features |

| Enterprise | Custom pricing | Large firms and institutional buyers |

– Custom users and reports – Dedicated support – All platform + API access – Custom products |

Key Features: AI Valuations, Forecasting, and Portfolio Intelligence

HouseCanary stands out for its ability to combine powerful AI with deep real estate data to give users fast, accurate insights. Below are the key features that make this platform valuable for professionals who need smarter tools to evaluate properties and market trends.

Instant, Accurate Property Valuations with HouseCanary AVMs

HouseCanary’s AVMs generate fast, highly accurate property valuations using advanced machine learning models. These valuations draw from millions of data points, including public records, MLS feeds, and historical trends. Users can quickly assess property value without waiting for manual appraisals.

This helps investors, lenders, and brokers move faster on deals while maintaining confidence in the numbers. AVMs are especially useful for screening multiple properties at once, allowing users to prioritize the strongest opportunities. They update frequently, ensuring values reflect current market conditions.

Predict Future Property Trends with HouseCanary’s Forecasting Tools

The platform’s forecasting tools predict future property values and market trends using AI-powered models. These forecasts go beyond recent sales, factoring in macroeconomic indicators, neighborhood growth, and pricing momentum. This helps users make forward-looking decisions instead of relying on outdated comps.

Whether planning a buy-and-hold investment or assessing long-term loan risk, these forecasts provide a strategic edge. They’re especially useful in volatile markets where timing and trend awareness are critical. HouseCanary users can adjust strategies with more clarity and confidence.

Risk Scores That Help You Avoid Bad Property Investments

HouseCanary assigns risk scores to properties and neighborhoods based on market volatility, local economics, and property-level data. These scores help users understand not just what a property is worth—but how stable or risky that value may be.

For lenders and institutional buyers, this is key to managing exposure and reducing financial risk. For investors, it highlights areas with growth potential or red flags. The scoring is fully automated, removing the need for hours of manual research. It supports more data-driven decisions across every stage of a deal.

Estimate Rental Income Potential with Smart AI Models

For rental property buyers or landlords, HouseCanary offers reliable rent estimates based on local market data and property features. These estimates help users understand income potential before making a purchase. The tool factors in location, unit size, market demand, and historical rental trends.

Whether someone is investing in a single property or planning to scale a rental portfolio, rent estimation makes the numbers easier to evaluate. It also helps lenders assess cash flow for rental loans. This feature simplifies income projections and supports smarter underwriting.

Track and Optimize Your Real Estate Portfolio in Real Time

HouseCanary allows users to manage and analyze entire portfolios, not just individual properties. This is especially helpful for institutional investors and property managers who need insights across hundreds of assets. Users can group properties, track value over time, compare performance by market, and flag high-risk holdings.

The interface is built for clarity, so large volumes of data are easy to review and act on. With bulk reporting and high-level visibility, users can keep strategy aligned with real-time market shifts. It’s portfolio intelligence at scale.

Explore New Deals with HouseCanary’s Smart Property Search

This feature lets users search and drill down into properties across the U.S. using filters like location, size, ownership, value trends, and more. It’s ideal for identifying potential deals, comp analysis, or scouting opportunities in unfamiliar markets. The tool blends mapping, data overlays, and quick insights in a single view.

Investors can instantly spot high-potential zip codes. Brokers can prepare faster CMAs. And lenders can zero in on areas of stability. It makes real estate research faster, visual, and actionable for any user.

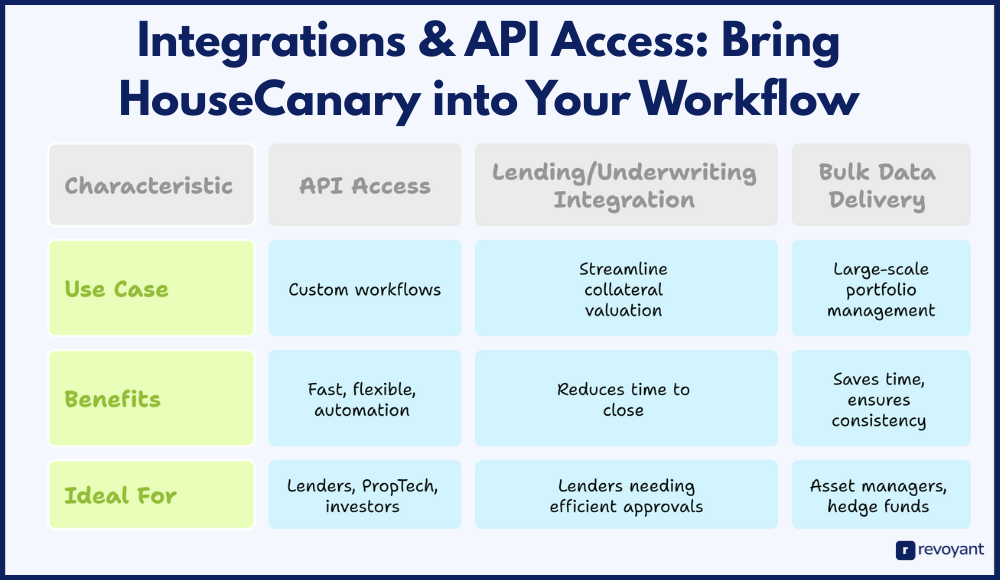

Integrations & API Access: Bring HouseCanary into Your Workflow

HouseCanary is designed to be more than just a standalone platform. For teams and companies that need to move faster and work smarter, its integration capabilities and API access make it easy to bring HouseCanary’s intelligence directly into existing systems.

API Access for Custom Workflows

HouseCanary offers robust API access, allowing businesses to connect its data and valuation models directly into their own platforms, apps, or decision engines. Developers can access property valuations, rent estimates, risk scores, and forecasting data programmatically.

This is especially valuable for lenders, PropTech companies, and institutional investors who need to scale processes without logging into a dashboard. It’s fast, flexible, and built for automation. Whether powering a loan underwriting tool or internal analytics dashboard, the API gives teams real-time property insights exactly where they need them.

Integration with Lending and Underwriting Systems

Lenders often integrate HouseCanary into their underwriting systems to streamline collateral valuation and risk analysis. By embedding real-time AVMs and market data into their workflow, they can approve or flag loans more efficiently. This reduces time to close, increases consistency, and supports stronger compliance with valuation standards.

Integrations are customizable to fit different loan products or evaluation criteria. It’s a practical way to bring AI-driven property intelligence into a process that often relies on outdated or fragmented data sources.

Bulk Data Delivery for Enterprise Use

For teams managing large-scale portfolios or datasets, HouseCanary provides bulk data delivery options. This includes property valuations, historical data, rent estimates, and market forecasts across thousands of properties. Users can import this data into their internal systems, CRMs, or analysis tools for deeper reporting and trend analysis.

This option is ideal for asset managers, hedge funds, or REITs that need insights across a wide footprint. Bulk access saves time and ensures decisions are based on consistent, accurate, and updated information across all assets.

HouseCanary Pros & Cons: Is It Right for Your Real Estate Needs?

When choosing any real estate analytics platform, it’s important to weigh the strengths and trade-offs. HouseCanary offers powerful features built for professionals, but like any tool, it may not be the perfect fit for every situation. Here’s a quick breakdown of the key pros and considerations to help you decide if it matches your needs.

| Pros | Cons |

|---|---|

| ✅ AI-powered property valuations with high accuracy | ❌ May offer more features than needed for basic users |

| ✅ Real-time market forecasts and risk scoring tools | ❌ Advanced features require Pro or higher-tier plans |

| ✅ Easy-to-use dashboard for property insights and reports | ❌ Limited customization options in lower-tier plans |

| ✅ API access for integrating with your own platform or workflow | ❌ Pricing for enterprise plans is not publicly listed |

| ✅ Scalable for individuals, teams, and large enterprises | ❌ Requires some onboarding to fully leverage all tools |

| ✅ Strong support for investors, lenders, brokers, and appraisers | ❌ Focused mainly on U.S. residential real estate |

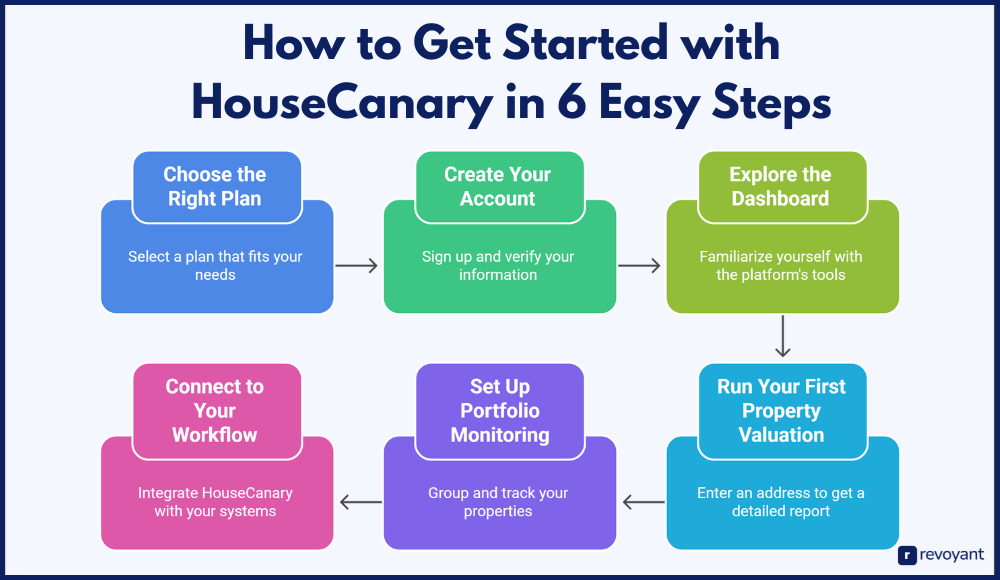

How to Get Started with HouseCanary in 6 Easy Steps

Getting started with HouseCanary is a simple, guided process designed to help users start extracting real value from day one. Whether you’re an investor, lender, or real estate team, the platform makes onboarding quick and intuitive. Follow these steps to launch your HouseCanary experience with confidence.

Step 1: Choose the Right Plan

Start by selecting the plan that best fits your needs. HouseCanary offers flexible options for individuals, small teams, and enterprise clients. If you’re just looking for occasional property insights, the Basic or Pro plans may be enough.

For businesses handling multiple transactions or managing a portfolio, the Teams or Enterprise plans provide more scale and tools. The right plan ensures you get only the features you need—nothing more, nothing less.

Consider these factors when choosing:

- How many reports will you need each month?

- Will you need portfolio monitoring or API access?

- How many users will be active on your team?

Step 2: Create Your Account

Once you’ve chosen a plan, sign up using your name, business email, and professional role. HouseCanary walks you through a brief onboarding process that verifies your information and gives you access to your dashboard. You’ll receive a welcome guide and tips to help you explore features right away. The setup process is smooth, so even first-time users can get started without needing technical help or training.

Step 3: Explore the Dashboard

Your HouseCanary dashboard is the central hub for property analysis, market insights, and reports. It’s designed to be intuitive and user-friendly, even for non-technical users. You’ll find key tools like valuation models, rental estimates, and forecasting right up front. Filters and search features make it easy to explore different areas, track properties, or dive into specific market data. Everything is organized to support fast, data-driven decisions.

Step 4: Run Your First Property Valuation

Running a valuation is as simple as entering a property address into the search bar. Within seconds, HouseCanary returns a detailed report that includes current value estimates, rental income projections, price trends, and neighborhood comps. This helps you understand the property’s current standing and future potential. The reports are clean, visual, and ready to share with clients or colleagues. You can also export them as PDFs if needed.

Each valuation report includes:

- Market value and confidence score

- Local rent projections and vacancy trends

- Recent sales comps and market trajectory

Step 5: Set Up Portfolio Monitoring (Optional)

If you’re managing multiple properties, HouseCanary’s portfolio monitoring feature helps you keep everything in view. You can group assets by location, property type, or investment stage, and track their performance over time. This is especially useful for identifying underperforming properties or flagging high-risk areas. Real-time alerts keep you informed as market conditions shift. It’s a practical way to scale your insights without increasing your workload.

Step 6: Connect to Your Workflow (Pro and Above)

Users on Pro plans or higher can integrate HouseCanary directly into their systems using the platform’s API. This is ideal for automating underwriting, powering in-house dashboards, or embedding valuation tools into client-facing platforms. After receiving your API key, setup includes defining your data endpoints, testing them with sample calls, and adjusting access controls.

The process is supported by detailed documentation and a responsive developer support team.s, setting access permissions, and testing endpoints with sample data. HouseCanary provides developer documentation and support to ensure smooth setup and ongoing use.

Top Alternatives to HouseCanary for Real Estate Analytics

While HouseCanary is a top choice for AI-powered real estate analytics, it’s not the only platform professionals rely on. Depending on your business model, budget, and technical needs, there are other powerful tools available that offer automated valuations, market data, and risk insights. Below are some of the most trusted HouseCanary alternatives, each with its own strengths, specialties, and ideal use cases. This comparison can help you evaluate the best fit for your real estate goals.

CoreLogic: Enterprise-Grade Real Estate & Lending Data

CoreLogic is one of the largest providers of property data and analytics in the U.S., with a strong focus on serving mortgage lenders, insurers, and government agencies. The platform delivers real estate, financial, and consumer information that supports risk management, loan underwriting, valuation accuracy, and market performance analysis. CoreLogic is known for its depth of data and its ability to support high-volume, institution-level decision-making.

It’s particularly valuable for organizations that need comprehensive, defensible data to drive compliance and reduce risk exposure. While not as sleek or startup-oriented as newer tools, CoreLogic offers enterprise-level precision and coverage that few others match.

CoreLogic Pricing

CoreLogic offers custom pricing based on your business model, data volume, and technical needs. It’s structured for high-usage teams and institutions.

- Custom pricing based on business type, volume, and data access requirements

- Enterprise contracts typically required for full platform use

Key Features of CoreLogic

This platform is built to deliver national-scale real estate insights with advanced risk and valuation tools for large organizations.

- Delivers national property data including tax, deed, mortgage, and transaction history for over 99% of U.S. properties

- Offers automated valuation models (AVMs) widely trusted in the mortgage and appraisal industries

- Provides risk management solutions including fraud detection, credit risk scoring, and default forecasting

- Integrates with loan origination systems and appraisal management platforms for end-to-end decision support

- Includes neighborhood trends, hazard risk, and market performance indicators for underwriting and investment decisions

CoreLogic Pros and Cons

CoreLogic is a highly trusted platform used by banks, insurers, and institutions that require comprehensive real estate data and automated valuations for regulatory or financial decision-making. It’s built more for scale and precision than for casual or individual users.

| Pros | Cons |

|---|---|

| ✅ Industry-standard AVMs used by top lenders and financial institutions | ❌ Pricing is not transparent and usually requires enterprise agreements |

| ✅ Extensive national coverage and deep historical data | ❌ Interface can feel outdated and not built for solo professionals |

| ✅ Strong integrations with mortgage and risk management systems | ❌ Focuses more on traditional lending needs than modern PropTech use |

| ✅ Trusted source for compliance, fraud prevention, and risk analysis | ❌ Not ideal for small investors or users with limited data needs |

ATTOM : Developer-Friendly Real Estate Data APIs

ATTOM is a leading real estate data provider known for its broad, multi-layered datasets covering everything from property records to neighborhood demographics. It’s built for businesses that want to integrate clean, reliable real estate data into their own platforms, apps, or decision-making processes.

ATTOM is widely used by PropTech companies, marketing agencies, insurance firms, and investors who need scalable access to national property insights. What sets ATTOM apart is its focus on data delivery—offering flexible APIs and bulk licensing options for deep integration. It’s ideal for organizations that want raw data they can turn into custom tools or analytics.

ATTOM Pricing

ATTOM uses flexible pricing models based on how you access and use their data. Whether through APIs or bulk downloads, pricing adjusts to your business size and volume needs.

- Tiered and custom pricing for API, bulk, or licensing access

- Quotes vary based on number of data sets and usage volume

Key Features of ATTOM

ATTOM provides raw, structured property data for developers and data teams. It covers residential and commercial properties with broad contextual insights.

- Offers detailed property data, including ownership, mortgage, deed, tax, and parcel boundaries across the U.S.

- Includes neighborhood-level insights such as crime rates, school ratings, and walkability scores for context-rich analysis

- Provides real estate market trends, rental estimates, and foreclosure data for both residential and commercial properties

- Flexible API options for developers looking to embed property data into apps, websites, or internal platforms

- Offers bulk data delivery and licensing for enterprise users that need offline access to massive data sets

ATTOM Pros and Cons

ATTOM is built for scale, flexibility, and customization—making it ideal for tech-savvy teams that want to embed real estate intelligence into their systems.

| Pros | Cons |

|---|---|

| ✅ Extensive national property data with multi-layered insights | ❌ Requires technical setup or dev resources for full integration |

| ✅ Developer-friendly APIs for custom platforms and products | ❌ Pricing depends on volume, so it may not suit smaller budgets |

| ✅ Rich neighborhood data including demographics, crime, and schools | ❌ No visual dashboard for non-technical users |

| ✅ Bulk data delivery available for offline or internal analytics | ❌ Designed more for data builders than everyday investors |

Reonomy: Commercial Real Estate Research & Ownership Insights

Reonomy is a commercial real estate (CRE) data platform that helps users discover, research, and connect with property owners across the United States. It’s built specifically for professionals in the commercial space like brokers, investors, and lenders who want access to off-market property insights.

With a strong focus on ownership data, building details, and contact information, Reonomy is ideal for deal sourcing and lead generation. It’s commonly used by those looking to find opportunities not listed on MLS or public marketplaces. The platform is cloud-based and designed to support prospecting at scale.

Reonomy Pricing

Reonomy offers subscription-based pricing with various tiers depending on access level and number of users. Enterprise pricing is available for teams.

- Custom pricing for teams, brokers, or institutional users

- Free trial available for new users in select regions

Key Features of Reonomy

Reonomy is designed for CRE professionals looking to identify off-market opportunities and understand property ownership in-depth.

- Provides ownership records, LLC data, contact details, and portfolio connections across commercial properties

- Offers deep filtering tools by asset type, building size, debt history, tenant info, and transaction history

- Includes map-based search, saved searches, and bulk export capabilities for lead generation

- Integrates with CRMs like Salesforce, allowing seamless data workflows

- Cloud-based access makes it easy to research and organize commercial opportunities from anywhere

Reonomy Pros and Cons

Reonomy is ideal for those focused on the commercial property space who want fast, reliable access to owner intel and off-market insights.

| Pros | Cons |

|---|---|

| ✅ Excellent for commercial real estate prospecting and lead generation | ❌ Not built for residential property research or valuations |

| ✅ Offers owner and portfolio data that’s hard to find elsewhere | ❌ Data may require verification for accuracy in some markets |

| ✅ CRM integrations help streamline outreach and pipeline tracking | ❌ Pricing may be high for solo users or occasional prospecting |

| ✅ Enables discovery of off-market deals with deep filters and mapping | ❌ Limited valuation tools compared to full analytics platforms |

Zillow Zestimate: Free AVMs for Homeowners & Buyers

Zillow Zestimate is a free, automated home valuation tool available to the public via Zillow’s platform. It uses a proprietary algorithm that analyzes public data, user-submitted details, and recent sales to estimate a property’s current market value.

While not designed for professional use, it’s one of the most widely recognized AVMs by consumers. Zestimate is best for homeowners, buyers, or casual investors who want a ballpark figure on a property’s worth without paying for a formal appraisal. It’s fast, accessible, and available for millions of properties across the U.S.

Zillow Zestimate Pricing

Zestimate is completely free to use through the Zillow website or mobile app. No subscription or registration is required for valuation lookups.

- Free for all users

- No paid plans or enterprise tiers

Key Features of Zillow Zestimate

Zestimate is built for convenience and speed, helping consumers quickly gauge property values with minimal input.

- Instantly estimates property values using public records, user-submitted data, and nearby sales

- Covers millions of homes across the U.S., with frequent updates based on market trends and data changes

- Offers interactive charts showing price history, tax assessments, and neighborhood comps

- Users can edit home details to improve estimate accuracy for listed or owned properties

- Integrated into Zillow listings for fast valuation reference alongside sale and rent listings

Zillow Zestimate Pros and Cons

Zestimate is a helpful tool for casual users or early-stage home research but lacks the depth professionals require for investment or lending decisions.

| Pros | Cons |

|---|---|

| ✅ Completely free and easy to use for homeowners and buyers | ❌ Not built for professional or institutional real estate workflows |

| ✅ Available for nearly every home in the U.S. | ❌ Estimates can vary widely depending on data quality and location |

| ✅ Useful for ballpark valuations and tracking general market trends | ❌ No risk scoring, forecasting, or in-depth analytics tools included |

| ✅ Users can update property info to improve accuracy | ❌ No API access or integration options for business platforms |

Mashvisor: Find Top Airbnb & Rental Investments Fast

Mashvisor is a real estate analytics platform designed specifically for investors focused on short-term rentals and Airbnb properties. It helps users evaluate cash flow potential, occupancy rates, and return on investment across different markets in the U.S. The platform pulls in Airbnb and traditional rental data to show income estimates, investment payback time, and neighborhood performance.

With visual tools and heatmaps, it’s beginner-friendly but also detailed enough for experienced rental investors. Mashvisor is especially useful for identifying the best areas for vacation rentals and managing income property performance.

Mashvisor Pricing

Mashvisor uses a subscription model with pricing tiers based on features and access. Plans vary for casual investors and professionals.

- Lite plan starts around $29.99/month

- Standard and Professional plans range from $49.99 to $99.99/month

- Annual discounts available

Key Features of Mashvisor

Mashvisor is built for residential rental analysis, offering tools that simplify decision-making for Airbnb and long-term investors.

- Calculates potential rental income and ROI based on Airbnb and traditional rental data

- Displays occupancy rates, cash-on-cash return, cap rates, and optimal rental strategy for each property

- Includes investment property heatmaps to highlight high-performing neighborhoods

- Users can search and filter listings by investment potential, price, location, or rental demand

- Allows users to compare short-term vs. long-term performance side-by-side for smarter strategy planning

Mashvisor Pros and Cons

Mashvisor is ideal for real estate investors focused on cash flow and rental performance, particularly in the short-term rental space.

| Pros | Cons |

|---|---|

| ✅ Great for analyzing short-term vs. long-term rental profitability | ❌ Focused only on residential rental investments |

| ✅ Visual tools and heatmaps make market comparison simple | ❌ Limited valuation depth for non-rental properties |

| ✅ Helps new investors find top Airbnb markets quickly | ❌ Not built for commercial or institutional use |

| ✅ Affordable pricing for individual users and small investors | ❌ No deep forecasting or API access for enterprise integration |

HouseCanary vs. Competitors: Which Platform Wins?

Choosing the right real estate analytics platform depends on your goals—whether you need in-depth valuation tools, raw data for development, or quick rental insights. Below is a side-by-side comparison of HouseCanary and its top alternatives to help you identify which solution aligns best with your needs and budget.

| Platform | Best For | Pricing | Key Strengths |

|---|---|---|---|

| HouseCanary | Real estate investors, lenders, and appraisers | $19/mo to custom plans |

|

| CoreLogic | Banks, lenders, insurers, large institutions | Custom enterprise pricing |

|

| ATTOM | PropTech companies, developers, and data teams | Custom plans based on use |

|

| Reonomy | Commercial brokers, lenders, and CRE prospectors | Custom pricing, trial |

|

| Zillow Zestimate | Casual homeowners and buyers | Free |

|

| Mashvisor | Short-term rental investors and Airbnb hosts | $29.99 to $99.99/mo |

|

Why Professionals Choose HouseCanary for Real Estate Decisions

With several real estate platforms on the market, HouseCanary stands out for professionals who need a balance of speed, accuracy, and intelligence. It’s more than just a valuation tool. It’s a decision engine that brings AI, analytics, and forecasting together in one platform. Here’s why HouseCanary may be the right choice for your real estate strategy.

Built for Professionals Who Rely on Precision

HouseCanary is designed for serious real estate professionals—investors, lenders, brokers, and appraisers—who can’t afford to work with rough estimates or outdated data. Its automated valuation models (AVMs) are built on deep property datasets and refined with machine learning to ensure accuracy.

Whether you’re underwriting loans or analyzing potential acquisitions, the platform delivers numbers you can trust. It’s ideal for users who want more than surface-level insights and need valuations backed by real-time data.

Combines AI with Market Intelligence

What sets HouseCanary apart is how it blends artificial intelligence with real estate market fundamentals. The platform doesn’t just report what a property is worth today. It forecasts future values, assesses market risk, and helps you spot emerging trends.

This kind of forward-looking insight is rare in real estate tools and gives professionals a competitive edge. If your strategy involves predicting where the market is going, HouseCanary gives you the data and models to lead, not follow.

Streamlined Workflow with Scalable Tools

HouseCanary simplifies property research without sacrificing depth. The dashboard is intuitive, the reports are clean and ready to share, and the platform supports everything from single-property lookups to full portfolio analysis. As your business grows, the platform grows with you, offering bulk data tools, team accounts, and API access for seamless integration. Whether you’re a solo investor or part of a lending team, it fits naturally into your workflow and saves time at every step.

Ideal for Real-Time Decisions and Long-Term Planning

In a fast-moving market, speed matters, and HouseCanary delivers instant, AI-powered valuations and forecasts when you need them most. But it’s also built for the long game. The platform helps users monitor property trends, assess portfolio health, and prepare for future market shifts. This combination of short-term agility and long-term strategy makes it a reliable tool whether you’re closing your next deal or planning a five-year investment roadmap.

Expert Tips: How to Maximize ROI with HouseCanary

HouseCanary is a powerful platform, but like any tool, how you use it makes a big difference. These tips are designed to help you get more value, save time, and make smarter property decisions—whether you’re just getting started or managing a large portfolio.

- Define your use case clearly so you can focus on the features that match your goals, whether that’s investing, lending, or portfolio analysis.

- Choose a plan that aligns with your actual workload and team size to avoid overpaying or missing out on essential tools.

- Run valuation, rent, and risk reports together to get a full picture of property performance and potential returns.

- Set up portfolio monitoring to track value changes, rental shifts, and market trends over time across multiple properties.

- Use filters and search tools to compare neighborhoods and cities before committing to a location or strategy.

- Integrate via API if you need scalable, automated access to property data within your own systems or applications.

- Download and share property reports to back up decisions, pitch deals, or enhance presentations with clients and partners.

- Stay informed about platform updates and new tools to make sure you’re taking advantage of everything HouseCanary offers.

Security and Accuracy

When dealing with real estate data, especially at scale, accuracy and data security aren’t optional—they’re essential. HouseCanary is built to meet the standards of both financial institutions and individual professionals who need dependable, secure tools for high-stakes decisions.

The platform uses proprietary automated valuation models (AVMs) that are trained on millions of data points including MLS feeds, tax records, property histories, and market trends. These models are continuously refined using real-time updates and machine learning, which keeps valuations aligned with current market conditions—not outdated comps.

From a security perspective, HouseCanary maintains rigorous data privacy standards and enterprise-grade protections. For organizations that require it, SOC 2 reports and compliance documentation are available upon request. API integrations also offer controlled access, so data flows securely into internal systems without exposing sensitive information.

Whether you’re making lending decisions or analyzing investment opportunities, HouseCanary is designed to deliver reliable insights backed by secure infrastructure and defensible data models.

Final Thoughts: Is HouseCanary the Right Fit for You?

HouseCanary brings together AI, property data, and predictive analytics to give real estate professionals a sharper, faster way to make decisions. Whether you’re an investor, lender, appraiser, or part of a growing team, the platform delivers real-time insights that go far beyond surface-level comps.

Compared to other tools on the market, HouseCanary stands out for its accuracy, scalability, and smart forecasting. If you’re looking for a data-driven edge in a competitive market, HouseCanary is a strong choice to power your next move.

FAQs About HouseCanary: Features, Pricing & Use Cases

What is HouseCanary used for?

HouseCanary is used for real estate analytics, automated property valuation, rent estimates, and market forecasting. It’s ideal for investors, lenders, appraisers, and real estate teams who want fast, accurate property insights.

How accurate are HouseCanary’s valuations?

HouseCanary’s automated valuation models (AVMs) are built using machine learning and vast property datasets. It delivers consistently reliable estimates trusted by professionals across the industry.

Does HouseCanary work for commercial real estate?

HouseCanary is primarily focused on residential properties. It’s best suited for single-family homes, rentals, and portfolios in the residential space.

Can I integrate HouseCanary with my existing software?

Yes, HouseCanary offers API access and integration options for users on Pro plans and above. It supports seamless workflows for lenders, developers, and enterprise users.

Is HouseCanary suitable for beginners?

Yes, the platform is user-friendly, with clean dashboards and easy-to-follow reports. It’s simple enough for new users and powerful enough for experienced professionals.