⚡ Why This Blog Matters

Invoicing is repetitive and error-prone—but Payman AI speeds it up by up to 5× using AI-powered automation, reducing manual data entry and getting payments faster.

🧠 What You’ll Learn Here

See how Payman AI auto-extracts invoice data (vendor, line items, totals), matches payments, suggests remittances, and generates ready-to-send invoices—all within a clean, user-friendly dashboard.

🎯 Who Should Read This

Ideal for small business owners, accountants, freelancers, and finance teams looking to streamline billing, reduce errors, and improve cash flow with AI.

If you’re still manually reviewing invoices, chasing approvals, or toggling between spreadsheets and emails, you’re not alone. For finance teams that want to save time, reduce friction, and move toward a more intelligent process, Payman AI offers a refreshingly simple solution.

With AI-powered invoice automation, Payman AI helps businesses move faster without sacrificing accuracy. It captures invoice data, routes approvals automatically, and initiates payments with minimal input from your team. This isn’t just about automation. It’s about giving your finance team more control, fewer bottlenecks, and more time to focus on what actually moves the business forward.

Key Takeaways

- Payman AI simplifies invoice processing by automating the entire workflow from data capture to payment.

- It reduces manual work, helping finance teams save time and minimize errors.

- The platform integrates with popular accounting and ERP systems, making adoption easy.

- Smart features like approval routing, PO matching, and real-time tracking improve efficiency and visibility.

- Payman AI is built to scale with your business, whether you’re handling hundreds or thousands of invoices.

What Is Payman AI? A Complete Overview of Its Invoice Automation Capabilities

Payman AI is an intelligent invoice automation platform that simplifies how businesses manage accounts payable. It uses artificial intelligence to extract invoice data, validate it, route it for approval, and process payments through a single, streamlined system.

Instead of relying on manual data entry or disconnected tools, Payman AI brings everything together. It reads invoice details, matches them with purchase orders or contracts, and sends them to the right person for approval. Once approved, payments are automatically scheduled or triggered based on your company’s workflow.

Why Manual Accounts Payable Processes Are Failing Finance Teams

Manual accounts payable processes might get the job done, but they come at a cost. When teams rely on spreadsheets, email threads, and data entry, it leads to delays, missed payments, and a lack of control.

Invoices can sit unnoticed in inboxes. Approvals stall because no one knows who should sign off next. Errors slip through because someone keyed in the wrong number. And by the time finance teams catch up, vendors are already sending follow-up emails.

Beyond the wasted time, there’s also the strain on your team. Skilled professionals end up chasing approvals instead of analyzing spend or improving processes. What should take minutes ends up taking hours. As your business grows, the problem only grows with it.

How Payman AI Solves Accounts Payable Challenges with Automation

Payman AI is built to solve this problem at the source. It automates each step of the invoice workflow — from capturing data the moment an invoice arrives to verifying its accuracy, routing it for approval, and initiating secure payments.

Instead of manually entering data, teams simply forward invoices to the system. Payman AI reads the content, matches it with existing records, and takes care of routing without anyone needing to chase it down. Approvers get notified instantly, and once signed off, payments are scheduled based on your business rules.

The result is a faster, more reliable, and far less stressful AP process. It doesn’t just save time — it gives finance teams the freedom to focus on strategy, not paperwork.

Who Should Use Payman AI? Ideal Use Cases by Team Size and Role

Payman AI is designed for finance teams that are ready to move past manual processes and bring more efficiency into their accounts payable operations. Whether you’re a small business managing a growing invoice load or a large enterprise dealing with complex approval chains, Payman AI fits into your workflow without the need for a massive system overhaul.

It’s especially valuable for:

- Accounts Payable Teams who want to cut time spent on repetitive tasks like data entry and manual approvals.

- Finance Managers and Controllers who need better visibility into invoice status, approvals, and spend trends.

- CFOs and Executives who want accurate financial data, stronger audit trails, and more strategic use of team resources.

- IT and Operations Leaders who need software that integrates with existing systems and scales with the business.

- Businesses with Remote or Distributed Teams who rely on cloud-based tools and mobile-friendly workflows to stay efficient and compliant.

From fast-growing startups to mid-sized companies and large enterprises, Payman AI supports organizations that are serious about improving their financial operations without adding unnecessary complexity.

Payman AI Pricing Plans (2025): Starter, Pro & Enterprise Compared

Every business has different needs, especially when it comes to finance operations. That’s why Payman AI offers flexible, transparent pricing options that scale with your invoice volume and team size. Whether you’re automating invoices for the first time or looking for a powerful upgrade to your current process, there’s a plan designed to deliver real value without overcomplicating your budget.

Each plan includes access to core automation tools like invoice capture, smart approval workflows, and payment processing — so you can streamline your AP process without hidden fees, long onboarding, or enterprise-only features locked behind paywalls.

| Plan | Monthly Price | Invoice Volume | Key Features |

|---|---|---|---|

| Starter | $99/month | Up to 200 invoices | 1 user, 1 integration, core automation tools, standard support |

| Pro | $249/month | Up to 1,000 | Multi-user access, custom workflows, major accounting system integrations, priority support |

| Enterprise | Custom pricing | Unlimited | API access, custom integrations, dedicated account manager, advanced analytics, SLA-backed support |

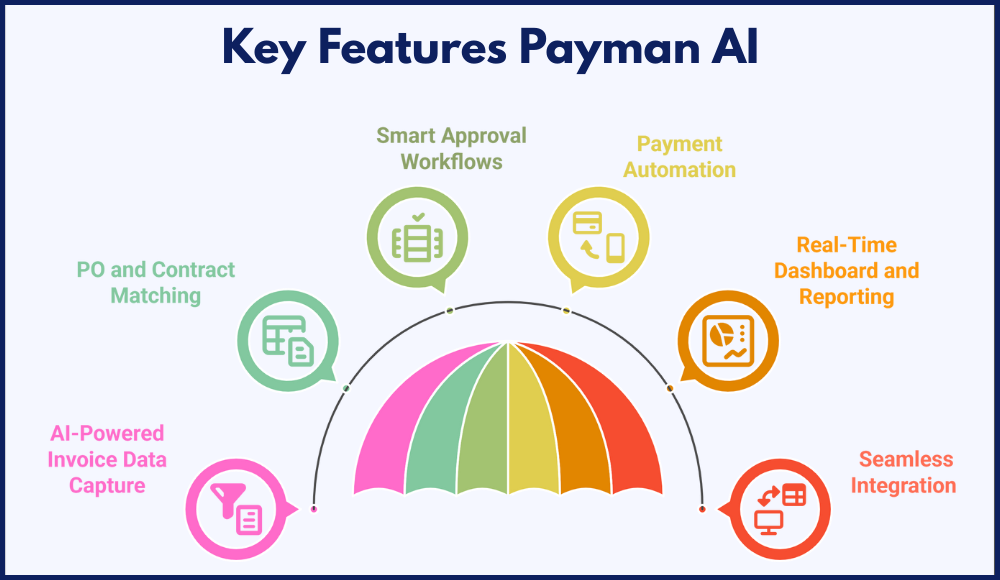

Key Features of Payman AI: Smart Invoice Processing from Start to Finish

Payman AI is built to simplify and speed up every step of the invoice-to-payment cycle. It doesn’t just automate tasks — it intelligently handles them in ways that reduce workload, increase accuracy, and give finance teams the visibility and control they need.

These features are designed to work together, helping businesses move faster while staying compliant and error-free.

AI Invoice Data Capture: Extract and Process Invoices in Seconds

Payman AI uses advanced optical character recognition (OCR) combined with machine learning to read and extract key invoice data the moment it arrives. Whether the invoice is a PDF, scanned image, or comes through email, the system identifies vendor names, dates, amounts, line items, and more — with high accuracy.

This eliminates the need for manual data entry and speeds up the intake process. It also reduces human error, which can lead to costly delays or payment mistakes. The AI improves over time by learning from your invoice patterns. Even complex or multi-page invoices are handled with ease. The goal is simple: get accurate data into your system faster so your team can act on it without double-checking every field.

PO and Contract Matching: Avoid Errors and Speed Up Payments

One of the most common delays in invoice processing is due to mismatches between invoices, purchase orders, and contracts. Payman AI solves this by automatically cross-referencing incoming invoices with your existing records. If everything matches, the invoice can move forward without manual review. If not, it flags the issue clearly for your team to resolve.

This drastically reduces the risk of overpayment, duplicate payment, or fraud. It also saves your team hours of back-and-forth tracking down documentation. Whether you’re matching one-to-one or one-to-many, Payman AI is built to handle complex matching scenarios with speed and clarity.

Smart Approval Workflows: Automate Routing by Role, Department, or Amount

Once invoice data is captured and verified, Payman AI routes it to the right people for approval — instantly. You can set custom approval rules based on amount, department, vendor, or any other criteria. Approvers receive notifications, can review invoices with all supporting documentation, and approve directly from their desktop or mobile device.

This prevents bottlenecks and keeps your payment cycle moving. No more chasing down approvers or guessing who’s next in line. Everything is tracked and timestamped for compliance and audit readiness. It’s simple, structured, and designed for speed.

Payment Automation: Auto-Schedule Payments with Zero Manual Effort

When invoices are approved, Payman AI can initiate payments automatically based on your predefined rules. Whether you’re using ACH, wire transfer, or integrating with a payment processor or ERP system, the platform handles the transaction securely and efficiently. You can schedule payments to hit just-in-time, optimizing your cash flow without risking late fees.

Payment confirmations, vendor notifications, and audit logs are all part of the workflow. This reduces workload, minimizes payment errors, and ensures consistency in how and when vendors get paid. You stay in control while reducing the day-to-day hands-on work.

Real-Time Dashboard: Monitor AP Performance and Approval Status Instantly

Visibility is everything in finance. Payman AI gives your team a real-time dashboard that shows invoice status, payment schedules, pending approvals, and historical data — all in one place. No more juggling spreadsheets or chasing down updates from team members.

You get a clear picture of where every invoice stands and how your AP process is performing overall. Built-in reporting tools help with audits, forecasting, and monthly reviews. You can filter by vendor, date, department, and more. This transparency helps your team make smarter decisions, stay ahead of deadlines, and remain audit-ready at all times.

Seamless Integrations: Connect Payman AI to QuickBooks, SAP, NetSuite & More

Payman AI is designed to plug into the tools your team already uses. It integrates smoothly with platforms like QuickBooks, NetSuite, SAP, Xero, and Microsoft Dynamics. You don’t need to overhaul your tech stack — Payman AI works alongside it. With open API access, you can also connect custom systems or build deeper integrations as needed.

Data flows securely between systems, keeping everything in sync without the need for manual transfers. The result is a unified workflow where invoices, approvals, and payments all live in one ecosystem. Setup is quick, and your team can start seeing value almost immediately.

Payman AI Pros and Cons: Is It the Right Invoice Automation Tool for You?

Before making a decision on any software, it’s important to weigh the strengths and limitations. Payman AI offers a wide range of features that improve invoice processing, but like any tool, it may not be the perfect fit for every team.

Here’s a balanced look at what it does well — and where you might want to consider your specific needs before moving forward.

| Pros | Cons |

|---|---|

| ✅ Seamless integration with QuickBooks, NetSuite, SAP, and more | ❌ May be more advanced than needed for very small teams |

| ✅ AI-powered data capture reduces errors and saves time | ❌ Setup requires initial configuration of workflows |

| ✅ Custom approval workflows adapt to your company’s structure | ❌ Not yet as widely known as legacy AP software |

| ✅ Real-time dashboards provide visibility into invoice and payment status | ❌ Some advanced features may go unused in basic use cases |

| ✅ Scales easily for small, mid-sized, and enterprise finance teams | ❌ Limited offline functionality — designed for cloud-first environments |

| ✅ Open API supports custom integrations and advanced use cases | ❌ Requires user training for full feature adoption |

How to Set Up Payman AI in 5 Easy Steps (No IT Required)

You don’t need a full IT team or a complex rollout plan to start using Payman AI. The platform is built for quick onboarding, clear setup, and immediate results. In just a few simple steps, your finance team can go from manual tasks to automated efficiency without interrupting your current workflow.

Step 1: Schedule a Demo or Start a Free Trial

The first step is to create an account on the Payman AI website or book a free demo. A quick walkthrough with a product specialist can help you understand how the system aligns with your invoice volume, approval structure, and team goals. It’s also a great way to get your questions answered and see key features in action.

If you prefer to explore on your own, the self-guided trial lets you test the platform hands-on. Either way, the goal is to get you familiar with how Payman AI can solve your current AP challenges from day one.

Step 2: Connect Payman AI to Your ERP or Accounting System

Once you’re in, the next step is to link your existing accounting or ERP system. Payman AI supports integrations with popular platforms like QuickBooks, NetSuite, SAP, Xero, and Microsoft Dynamics. These connections are secure and require minimal setup.

You’ll be guided through the process, and your data will sync automatically with no manual transfers needed. This integration ensures that invoices, payments, vendors, and financial records all stay aligned. With everything connected, your automation workflow can start working immediately.

Step 3: Customize Approval Workflows and Routing Logic

Payman AI adapts to how your team already operates. In this step, you’ll configure custom rules, such as:

- Who needs to approve invoices based on department, role, or invoice value

- The order of approval routing for different types of transactions

- Exceptions for recurring or low-value invoices that can bypass manual approval

These settings ensure you maintain control while eliminating bottlenecks. The system is flexible enough to evolve with your team’s needs over time.

Step 4: Upload, Forward, or Auto-Sync Your Invoices

With your system ready, you can start importing invoices. Options include:

- Uploading files directly through the dashboard

- Forwarding invoices by email

- Setting up auto-sync with connected vendor portals or folders

Payman AI extracts all essential data, checks for duplicates, and validates entries. This makes the review process faster, cleaner, and much more scalable.

Step 5: Go Live with Payman AI and Start Automating Immediately

Once your system is connected and your rules are in place, you’re ready to go live. Payman AI starts processing invoices and routing approvals automatically, and you’ll see results quickly — faster turnaround, fewer errors, and clearer visibility into your accounts payable.

Most teams are fully operational within just a few business days. Support is available anytime if you need help or want to fine-tune your setup. From here on out, your AP process runs smarter, with less effort and more control.

Top Alternatives to Payman AI Compared: Bill.com, Tipalti, Stampli & More

Choosing the right accounts payable automation software often comes down to specific business needs — like volume, complexity, team size, and integrations. While Payman AI offers a modern, AI-driven approach, it’s worth comparing it to other trusted platforms in the market.

Below are some of the top alternatives, each with its own strengths, pricing structure, and ideal use case. This section helps you understand how Payman AI stacks up against other solutions, so you can make an informed decision based on what fits your team best.

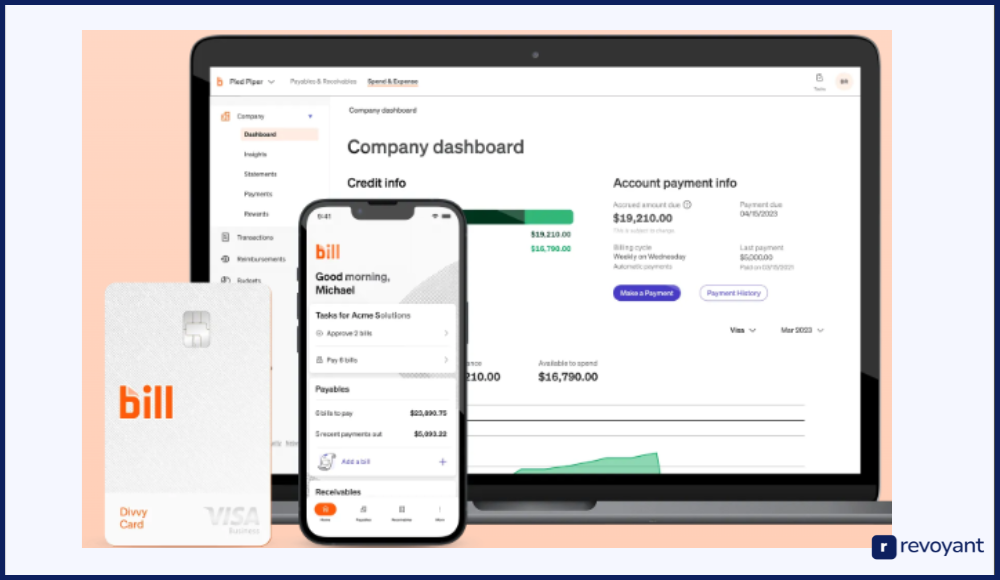

Bill.com Overview: Simple AP Automation for Small and Mid-Sized Businesses

Bill.com is a trusted accounts payable platform designed to help small and mid-sized businesses digitize and automate their invoice and payment processes. It replaces manual steps with a centralized system that integrates directly with popular accounting software.

Bill.com focuses on ease of use, reliable payment processing, and integration readiness — offering a straightforward way to modernize AP operations without the complexity of enterprise-level tools.

Key Features of Bill.com

Bill.com includes the core functionality you’d expect from a mature AP automation solution. While it doesn’t offer advanced AI or predictive automation, it covers all the key steps from invoice capture to payment processing.

- Invoice capture through email, upload, or scanning, with basic OCR to extract invoice data for quicker processing.

- Custom approval routing that allows invoices to follow rule-based workflows for review and sign-off based on role, amount, or department.

- Payment processing via ACH, checks, and international wires, all handled securely within the platform.

- Vendor management tools to store payment details, tax forms, and contact information in one place.

- Audit trails and activity logs that record every action taken on each invoice, supporting compliance and reviews.

- Integrations with QuickBooks, Xero, Sage Intacct, and NetSuite to eliminate duplicate data entry and keep accounting synced.

- Mobile access for reviewing and approving invoices from anywhere using the Bill.com app.

Bill.com Pricing

Bill.com offers pricing plans based on user roles and business needs. Each tier unlocks additional features and integrations, allowing teams to scale their usage as their invoice volume grows.

| Plan | Monthly Price | Includes |

|---|---|---|

| Essentials | $45/user/month | Basic invoice management, payments, QuickBooks/Xero integration |

| Team | $55/user/month | Multiple users, approval policies, sync with accounting software |

| Corporate | $79/user/month | Multi-entity support, advanced roles, deeper integrations |

| Enterprise | Custom pricing | Tailored features, ERP integrations, dedicated success manager |

Prices may vary based on selected integrations and usage.

Pros

Bill.com is built for businesses that want a simple, reliable way to manage accounts payable without overcomplicating their tech stack. It delivers core automation with strong integrations and excellent usability, especially for finance teams without in-house IT.

- User-friendly interface with minimal setup required

- Seamless integration with popular accounting tools like QuickBooks and Xero

- Streamlined payment processing via ACH, checks, and wires

- Centralized system keeps invoices, approvals, and payments in one place

- Strong vendor management features to simplify onboarding and record-keeping

- Mobile app support makes invoice approval fast and accessible

Cons

While Bill.com covers the basics well, it may not be the best fit for teams looking for deep customization or intelligent automation. Its workflow tools are limited compared to more modern platforms, and costs can increase quickly as teams grow.

- Lacks advanced AI features like smart invoice reading or predictive routing

- Approval workflows are more rigid and harder to customize for growing orgs

- Pricing is per user, which can add up quickly as teams expand

- Interface feels dated compared to newer AP platforms

- No built-in purchase order (PO) matching capabilities

- Limited support for highly specialized international payment needs

Tipalti Review: Best for Global Payments and Enterprise AP Automation

Tipalti is an advanced accounts payable and global payments automation platform built for high-growth and enterprise-level companies. It goes beyond basic AP automation by offering end-to-end capabilities — from invoice capture and approval workflows to tax compliance, fraud detection, and international payments in over 190 countries.

Tipalti is especially strong for finance teams managing multi-entity operations, large volumes of invoices, and payments across currencies and regulations. While it’s more complex than some other platforms, it delivers serious firepower for companies that need to centralize, scale, and control global payables with precision.

Key Features of Tipalti

- Intelligent invoice processing that automates data extraction, approval routing, and payment scheduling with minimal manual input.

- Global payments engine supporting 120 currencies, six payment methods, and full tax compliance in 190+ countries.

- Supplier onboarding portal that allows vendors to self-register, submit payment info, and upload tax documents securely.

- Built-in tax and regulatory compliance tools including W-8/W-9 collection, FATCA support, and OFAC screening.

- Advanced fraud detection and audit trails that reduce risk and ensure transparent payment processes.

- Multi-entity support allowing businesses to manage AP across subsidiaries with separate workflows and reporting.

- Integrations with ERP systems like NetSuite, Sage Intacct, Oracle, QuickBooks, and others for seamless financial data sync.

Tipalti Pricing

Tipalti does not publish fixed monthly pricing on its website. Pricing is custom based on:

| Plan Level | Typical Pricing | Includes |

|---|---|---|

| Growth | Starts around $1,000/month | Core AP automation, invoice capture, domestic payments, vendor portal |

| Enterprise | Custom quote | Global payments, tax compliance, multi-entity support, fraud protection |

Pricing depends on invoice volume, number of entities, and feature scope.

Pros

Tipalti is a powerhouse for companies that deal with global finance complexity. Its compliance-first approach, international capabilities, and automation depth make it a great fit for finance leaders managing high volume, cross-border workflows.

- End-to-end automation from invoice intake to global payment execution

- Built-in tax compliance, fraud prevention, and regulatory features

- Handles multiple subsidiaries and currencies from one platform

- Strong ERP integrations for accurate and real-time financial data

- Scales with business growth and operational complexity

- Vendor onboarding and self-service tools save time for AP teams

Cons

Tipalti’s depth and global capabilities come at a cost — both financially and in terms of implementation effort. It’s best suited for companies that truly need that level of control and scale.

- Higher upfront cost compared to SMB-focused AP tools

- Longer implementation timeline due to system complexity

- Overkill for companies with basic domestic AP needs

- UI can feel dense to new users, especially without onboarding support

- Some features locked behind higher pricing tiers

- Requires clear internal processes to fully utilize its capabilities

Stampli Review: Best AP Tool for Collaboration and Exception Handling

Stampli is an AP automation platform that focuses heavily on collaboration and communication within the invoice process. Unlike traditional tools that simply automate workflows, Stampli centralizes conversations, documents, and approvals around each invoice. This makes it a standout option for teams that deal with frequent exceptions, manual back-and-forth, or need clearer accountability in their approval process.

Stampli is particularly well-suited for mid-sized and larger companies with multiple departments involved in accounts payable. Its visual interface and real-time messaging tools help keep everyone on the same page. While it may not offer the same global payment infrastructure as platforms like Tipalti, it excels at speeding up approvals and reducing internal confusion.

Key Features of Stampli

- Collaborative invoice management that brings finance, approvers, and stakeholders into one centralized conversation thread per invoice.

- AI assistant (named “Billy the Bot”) that automates coding, categorization, and flagging of inconsistencies based on historical behavior.

- Real-time communication tools that allow comments, questions, and clarifications to be tracked directly on the invoice.

- Approval workflows that are customizable by role, amount, or project, helping invoices move quickly without confusion.

- Document and audit trail storage that keeps all notes, decisions, and file attachments connected to each invoice.

- Integrations with ERPs like NetSuite, Sage Intacct, Microsoft Dynamics, QuickBooks, and more.

- Mobile and cloud access for reviewing and approving invoices from anywhere.

Stampli Pricing

Stampli doesn’t publicly list pricing on its website, as plans are customized based on your business size, invoice volume, and integration needs. Here’s a general idea:

| Plan Level | Pricing Estimate | Includes |

|---|---|---|

| Core | Custom pricing | Core invoice processing, approval workflows, and basic integrations |

| Growth | Custom pricing | Multi-user support, collaboration features, ERP integrations |

| Enterprise | Custom pricing | Advanced analytics, API access, dedicated onboarding and support |

Free trials and demos are available upon request.

Pros

Stampli is ideal for teams that need strong collaboration and fast resolution of invoice-related questions. It’s built to cut the friction between AP, approvers, and departments by making communication part of the workflow — not something that happens separately.

- Real-time communication reduces approval delays and confusion

- AI-driven coding suggestions save time and improve accuracy

- Every invoice is treated like a live workspace with comments and context

- Easy to adopt for non-finance users due to intuitive interface

- Strong audit trail helps with accountability and compliance

- Integrates well with major ERP systems

Cons

While Stampli shines in collaboration, it may not offer everything larger or international businesses need from a global AP platform. It’s great at speeding up human decisions, but less focused on payment automation or vendor self-service.

- No built-in global payment infrastructure like Tipalti

- Pricing is not transparent and can vary significantly

- May be too feature-rich for very small or simple AP processes

- Some automation features depend on historical invoice volume to improve

- Less focused on tax compliance and regulatory tools

- Requires training to get full value from collaboration tools

AvidXchange Review: High-Volume AP Automation for Large Enterprises

AvidXchange is an enterprise-grade accounts payable solution built for mid-sized to large businesses that process high volumes of invoices each month. The platform is designed to automate every step of the AP lifecycle — from invoice receipt and approval workflows to payment execution while supporting complex internal controls and audit readiness.

It’s particularly well-suited for companies operating across multiple departments or locations that require scalability, strict compliance, and full visibility into cash flow. AvidXchange offers both AP and payment services, allowing organizations to digitize their payables and move away from paper checks and manual processes entirely.

Key Features of AvidXchange

- Invoice capture through OCR and digital workflows that eliminate the need for manual data entry and paper handling.

- Rule-based approval workflows tailored to departments, roles, and invoice types, making it ideal for multi-level organizations.

- Centralized dashboard for tracking invoice statuses, approvals, and audit trails in real time.

- Secure payment processing including ACH, check, and virtual card options through AvidPay.

- Vendor network access for simplified vendor onboarding, payment delivery, and communication.

- Customizable controls for security, fraud prevention, and compliance with internal finance policies.

- ERP integrations with systems like NetSuite, Microsoft Dynamics, Sage, SAP, and more.

AvidXchange Pricing

AvidXchange offers customized pricing based on company size, invoice volume, and payment needs. Typical pricing starts higher than SMB-focused tools due to its enterprise orientation.

| Plan Level | Pricing Estimate | Includes |

|---|---|---|

| Core | Custom pricing | Invoice automation, basic approval workflows, reporting |

| Pro | Custom pricing | Enhanced workflows, fraud controls, AvidPay integration |

| Enterprise | Custom pricing | Full AP and payments automation, custom security settings, multi-entity support |

Implementation fees and onboarding support are typically included in enterprise plans.

Pros

AvidXchange is designed for finance teams that need serious automation, scalability, and control. It’s a strong fit for industries like real estate, construction, and healthcare, where volume and compliance requirements are high.

- Handles high-volume AP with ease and reliability

- Automates both invoice processing and payments from end to end

- Strong audit trails and fraud prevention capabilities

- Deep integration with leading ERP systems

- Centralized platform reduces complexity across business units

- Trusted by large organizations and industry-specific verticals

Cons

AvidXchange is built for scale, but that means it comes with more complexity — and a steeper price tag. It’s best for companies that truly need its depth and are ready for an enterprise-level implementation.

- Not ideal for small or early-stage businesses

- Implementation can be time-consuming depending on ERP complexity

- Pricing is not transparent and typically starts at a premium level

- Less flexibility for teams wanting a lightweight or quick-start solution

- May require internal IT involvement during setup and integration

- Some users report slower customer support during high-demand periods

MineralTree Review: Mid-Market Invoice Automation and Built-In Payments

MineralTree is a cloud-based AP automation platform that focuses on helping mid-sized businesses streamline their invoice-to-payment process. It’s known for being highly intuitive, offering rapid onboarding, and integrating easily with popular accounting systems. MineralTree automates invoice capture, approval routing, and payments — all from one unified dashboard.

It’s a popular choice for finance teams that want to modernize their AP without taking on the complexity of full enterprise tools. With a strong emphasis on security and payment control, MineralTree makes it easy for companies to gain visibility into spend, reduce fraud risk, and close the books faster.

Key Features of MineralTree

- Smart invoice capture using OCR and AI to extract data and reduce manual entry.

- Configurable approval workflows that match your company’s roles and spending limits.

- Built-in payment processing for ACH, checks, virtual cards, and wires — including payment scheduling and batch processing.

- Centralized dashboard to manage invoices, approvals, and payments in one place.

- Fraud detection and dual-authorization tools to reduce risk during payment execution.

- Real-time reporting and analytics that provide visibility into cash flow and AP performance.

- Integrations with QuickBooks, NetSuite, Intacct, Microsoft Dynamics, and other accounting platforms.

MineralTree Pricing

MineralTree’s pricing is based on invoice volume, number of users, and selected features. Plans are typically offered via quote after a product demo.

| Plan Level | Pricing Estimate | Includes |

|---|---|---|

| Core | Custom pricing | Invoice capture, approval workflows, ACH/check payments |

| Growth | Custom pricing | Multi-user support, virtual card payments, fraud protection |

| Enterprise | Custom pricing | API access, advanced reporting, dedicated support, ERP integrations |

Demos and personalized pricing are available on request.

Pros

MineralTree is ideal for mid-sized businesses that want easy-to-use AP automation with strong payment features. It combines simplicity with control, helping finance teams improve speed and accuracy without overhauling their systems.

- User-friendly platform with fast onboarding

- Offers both AP automation and built-in payment processing

- Integrates with leading accounting tools and ERPs

- Helps reduce fraud through payment security features

- Excellent visibility into cash flow and invoice status

- Great fit for mid-market companies that want modern automation without complexity

Cons

MineralTree is built for mid-sized businesses, so it may not have the scalability or deep global payment features that larger enterprises require. It also lacks some of the advanced AI capabilities found in newer platforms.

- Limited global payment and compliance features

- Not ideal for high-volume, multi-entity enterprise setups

- AI and machine learning features are basic compared to newer tools

- Custom integrations may require additional support

- Pricing can be a barrier for small businesses

- Some functions, like advanced analytics, are reserved for top-tier plans

Payman AI vs Competitors: Feature-by-Feature Comparison Table

Choosing the right AP automation platform depends on your team’s size, complexity, invoice volume, and priorities — like collaboration, global payments, or ease of setup. Here’s a side-by-side look at how Payman AI compares with other leading tools in the space.

| Tool | Best For | Strengths | Pricing |

|---|---|---|---|

| Payman AI | Businesses of all sizes needing smart AP automation | AI-driven processing, fast setup, customizable workflows | Starts at $99/month |

| Bill.com | Small to mid-sized businesses | Simple interface, strong integrations, mobile-friendly | Starts at $45/user/month |

| Tipalti | Global, high-growth, multi-entity companies | Global payments, compliance tools, multi-subsidiary support | Starts around $1,000/month |

| Stampli | Teams needing invoice collaboration | Real-time invoice chat, AI assistant, great for exception handling | Custom pricing |

| AvidXchange | Large enterprises with high invoice volume | Enterprise-grade automation, deep ERP integrations | Custom pricing |

| MineralTree | Mid-sized companies seeking AP + payment control | User-friendly, built-in payments, good fraud protection | Custom pricing (quote-based) |

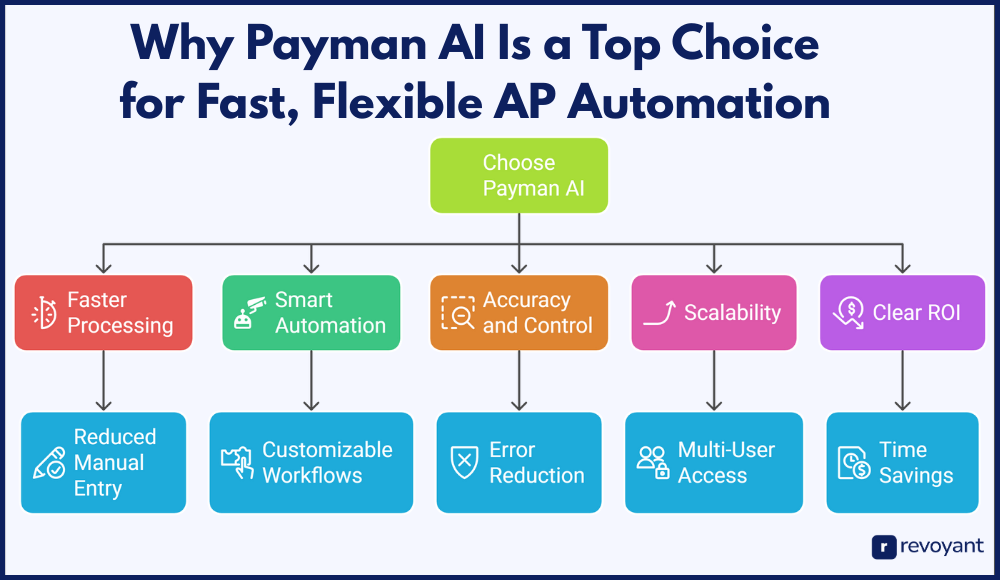

Why Payman AI Is a Top Choice for Fast, Flexible AP Automation

When you’re comparing AP automation platforms, it’s not just about features. It’s about choosing a system that fits how your team works today and where your business is headed.

Payman AI combines powerful automation with simplicity, giving finance teams the tools they need to move faster, stay accurate, and stay in control.

Process Invoices Faster Without Complexity or Long Onboarding

Payman AI is designed for speed, not just in invoice processing but in how quickly your team can get up and running. The platform uses AI to capture, validate, and route invoices automatically, reducing approval delays and freeing your team from manual entry.

Unlike enterprise tools that require weeks of onboarding, Payman AI can be implemented in days. It works with your existing accounting software, so you don’t have to change your system to see results. For teams that need quick wins without a steep learning curve, it’s a clear advantage.

Adaptive Automation: Tailor Workflows Without Compromising Speed

Automation works best when it fits your process, not the other way around. Payman AI lets you customize approval workflows based on your company’s roles, departments, and invoice types. The system learns patterns over time, recommending coding and routing logic based on past behavior.

Whether you manage simple purchases or complex vendor contracts, the platform adapts without requiring constant reconfiguration. This flexibility helps maintain accuracy while keeping everyone aligned and accountable.

Ensure Accuracy and Control with AI-Powered Invoice Matching

Payman AI helps finance teams reduce errors by automating the most error-prone tasks like data entry, matching invoices to POs, and checking for duplicates. Every invoice passes through a smart validation layer that flags issues before they create problems down the line.

The result is fewer exceptions, more reliable payments, and cleaner books at month-end. Plus, the system keeps a full audit trail of every action, helping you stay compliant and confident during reviews or audits.

Scales Your AP Operations Effortlessly with Payman AI

Whether you’re processing 100 invoices a month or 10,000, Payman AI scales to meet your needs without extra complexity. It supports multi-user access, layered approval rules, and integrations with ERPs like QuickBooks, Xero, and NetSuite.

As your business grows, Payman AI grows with you, offering tools to handle more volume, manage new vendors, and onboard team members quickly. You don’t need to start over when your company expands. Just build on the automation already in place.

Real ROI: Save Time, Cut Errors, and Improve Cash Flow with Payman AI

Payman AI isn’t just a tool. It’s an investment that pays for itself quickly. Teams that adopt it report major time savings, faster approvals, and fewer late payment fees. With reduced manual work and improved accuracy, the platform delivers real cost and time benefits from the start. There’s no need for complicated contracts or multi-month implementations. You can start small, prove the value, and scale confidently as your needs grow.

Payman AI Integrations: Compatible with QuickBooks, NetSuite, SAP & More

One of the biggest concerns when choosing finance software is whether it will fit with the tools you already use. Payman AI is built to integrate smoothly with popular accounting and ERP platforms, so you don’t have to disrupt your existing workflow to gain the benefits of automation.

It connects with systems like QuickBooks, NetSuite, SAP, Xero, Microsoft Dynamics, and more. Whether you’re managing invoices in a small business cloud setup or a complex multi-entity enterprise environment, Payman AI can sync your data automatically. Integration takes just a few steps and requires minimal IT effort.

For businesses with custom systems or unique requirements, Payman AI also offers a flexible API. This allows your internal tech team to build secure, custom connections for full control and scalability. The platform is designed to plug in quickly and deliver value without creating tech headaches.

What’s the ROI of Payman AI? How It Saves Time, Cost, and Headcount

Payman AI doesn’t just save your team time — it drives measurable financial value. By reducing the need for manual data entry, speeding up approval workflows, and cutting down on payment errors, the platform helps finance teams operate more efficiently and accurately.

Most companies report up to 70–80% faster invoice processing times after adopting Payman AI. This not only improves vendor relationships by eliminating late payments, but also reduces overhead costs tied to manual review, paper storage, and rework.

With fewer errors and better visibility, your month-end close becomes smoother and audit readiness improves. Finance leaders also gain access to real-time data that helps with forecasting, cash flow management, and smarter decision-making. From day one, the ROI is clear in both hours saved and money protected.

Final Verdict: Should You Use Payman AI for Invoice Automation in 2025?

Automating your accounts payable process isn’t just about saving time — it’s about gaining control, reducing errors, and giving your finance team the space to focus on strategy.

Payman AI offers a smart, flexible solution that adapts to your business and integrates with your existing systems. From AI-powered invoice capture to customizable approvals and seamless payments, it streamlines the entire AP workflow in one platform.

Whether you’re handling hundreds or thousands of invoices, Payman AI brings structure, speed, and clarity to your AP operations. It’s a practical step toward building a smarter, more efficient finance process.

Payman AI FAQs: Everything You Need to Know Before You Buy

How long does it take to set up Payman AI?

Most teams are up and running within a few business days. The setup process is designed to be fast and user-friendly, with guided onboarding and easy integration with your existing accounting tools.

Does Payman AI work with my current accounting software?

Yes. Payman AI integrates with leading platforms like QuickBooks, NetSuite, Xero, SAP, and Microsoft Dynamics. It also offers API access for businesses with custom or legacy systems.

Is Payman AI secure and audit-ready?

Absolutely. Payman AI includes audit trails, role-based permissions, and data validation layers to ensure every step is traceable and compliant. It’s designed with financial security and internal controls in mind.

Can it handle multi-user or multi-approval workflows?

Yes. You can configure custom workflows based on invoice value, department, project, or vendor. Multi-user access makes it easy for teams across locations to collaborate and approve efficiently.

What kind of support does Payman AI offer?

Payman AI provides live support, email assistance, and onboarding help. Pro and Enterprise plans also include priority support and dedicated account managers for ongoing optimization.